Question: Question 6: Prepare adjusting entries _(17 marks) Parker Tools is a tool and machinery company. As an accountant of the company, you need to complete

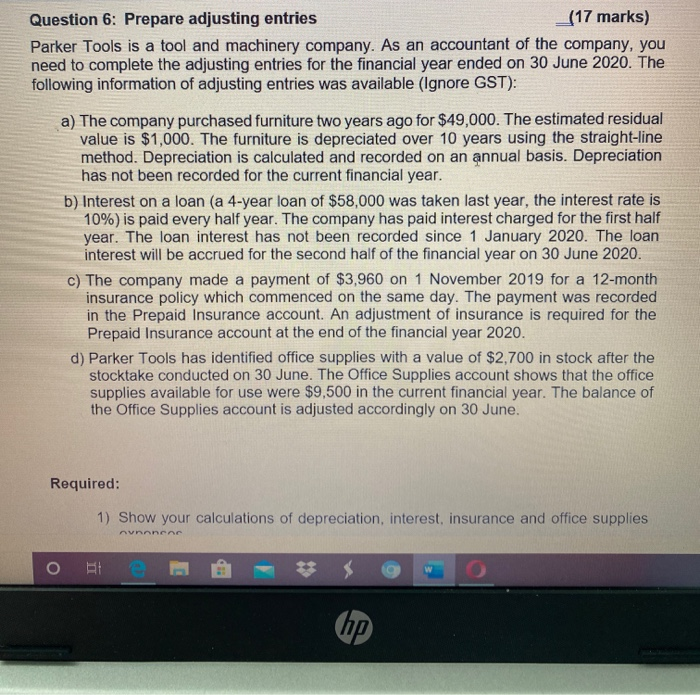

Question 6: Prepare adjusting entries _(17 marks) Parker Tools is a tool and machinery company. As an accountant of the company, you need to complete the adjusting entries for the financial year ended on 30 June 2020. The following information of adjusting entries was available (Ignore GST): a) The company purchased furniture two years ago for $49,000. The estimated residual value is $1,000. The furniture is depreciated over 10 years using the straight-line method. Depreciation is calculated and recorded on an annual basis. Depreciation has not been recorded for the current financial year. b) Interest on a loan (a 4-year loan of $58,000 was taken last year, the interest rate is 10%) is paid every half year. The company has paid interest charged for the first half year. The loan interest has not been recorded since 1 January 2020. The loan interest will be accrued for the second half of the financial year on 30 June 2020. c) The company made a payment of $3,960 on 1 November 2019 for a 12-month insurance policy which commenced on the same day. The payment was recorded in the Prepaid Insurance account. An adjustment of insurance is required for the Prepaid Insurance account at the end of the financial year 2020. d) Parker Tools has identified office supplies with a value of $2,700 in stock after the stocktake conducted on 30 June. The Office Supplies account shows that the office supplies available for use were $9,500 in the current financial year. The balance of the Office Supplies account is adjusted accordingly on 30 June. Required: 1) Show your calculations of depreciation, interest, insurance and office supplies innen o BE Required: 1) Show your calculations of depreciation, interest, insurance and office supplies expenses. I 2) Record adjusting entries as shown in items a), d). 3) Explain the impact of adjusting entries as shown in items a) - d) on the financial statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts