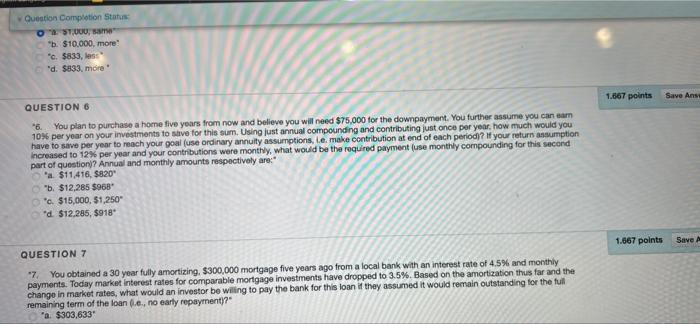

Question: question 6 Question Completion Status O ST.000, b. $10,000, more! *c. $833, less d. $833, more 1.667 points Save Ans QUESTION 6 6. You plan

Question Completion Status O ST.000, b. $10,000, more! *c. $833, less d. $833, more 1.667 points Save Ans QUESTION 6 6. You plan to purchase a home five years from now and believe you will need $75,000 for the downpayment. You further assume you can earn 10% per year on your investments to live for this sum. Using just annual compounding and contributing just once per year, how much would you have to save per year to reach your goal use ordinary annuity assumptions, le, make contribution at end of each period? If your return assumption Increased to 12% per year and your contributions were monthly, what would be the required payment (use monthly compounding for this second part of question)? Annual and monthly amounts respectively are: a $11.416, 5820 b. $12,285 $968 "c. $15,000, 51,250" d $12,285, $918 1.667 points Save A QUESTION 7 7 You obtained a 30 year fully amortizing, $300,000 mortgage five years ago from a local bank with an interest rate of 4.5% and monthly payments. Today market interest rates for comparable mortgage investments have dropped to 3.5%. Based on the amortization thus far and the change in market rates, what would an investor be willing to pay the bank for this loan if they assumed it would remain outstanding for the full remaining term of the loan (... no early repayment? a $303,633

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts