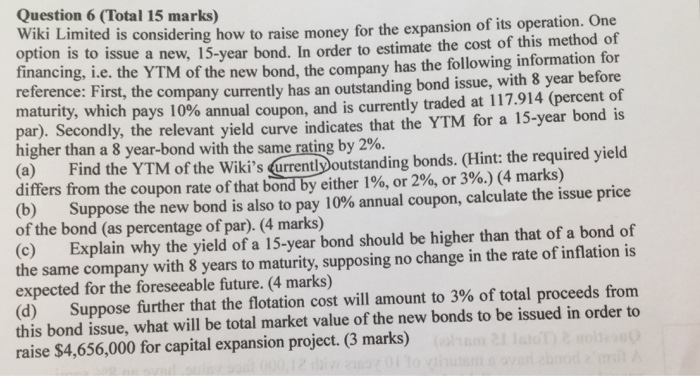

Question: Question 6 (Total 15 marks) Wiki option is to issue a new, 15-year bond. In order to estimate the cost of this method of finan

Question 6 (Total 15 marks) Wiki option is to issue a new, 15-year bond. In order to estimate the cost of this method of finan Limited is considering how to raise money for the expansion of its operation. One cing, i.e. the YTM of the new bond, the company has the following information for reference: First, the company currently has an outstanding bond issue, with 8 year before maturity, which pays 10% annual coupon, and is currently traded at 117.914 (percent of par). Secondly, the relevant yield curve indicates that the YTM for a 15-year bond is higher than a 8 year-bond with the same rating by 2%. (a) Find the YTM of the Wiki's (urrentlpoutstanding bonds. (Hint: the required yield differs from the coupon rate of that bond yeither 1%, or 2%, or 3%) (4 marks) (b) Suppose the new bond is also to pay 10% annual coupon, calculate the issue price of the bond (as percentage of par). (4 marks) (c) Explain why the yield of a 15-year bond should be higher than that of a bond of the same company with 8 years to maturity, supposing no change in the rate of inflation is expected for the foreseeable future. (4 marks) (d) Suppose further that the flotation cost will amount to 3% of total proceeds from this bond issue, what will be total market value of the new bonds to be issued in order to raise $4,656,000 for capital expansion project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts