Question: Question 6 - Total 8 marks a) A corn planter plans to sell all his corn on the futures market in August 2021, based on

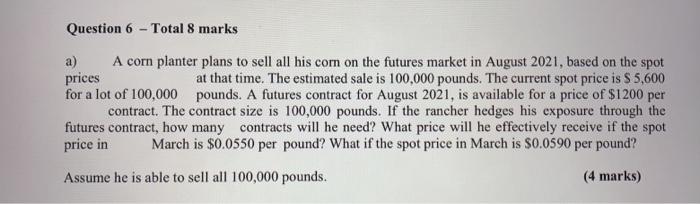

Question 6 - Total 8 marks a) A corn planter plans to sell all his corn on the futures market in August 2021, based on the spot prices at that time. The estimated sale is 100,000 pounds. The current spot price is S 5,600 for a lot of 100,000 pounds. A futures contract for August 2021, is available for a price of $1200 per contract. The contract size is 100,000 pounds. If the rancher hedges his exposure through the futures contract, how many contracts will he need? What price will he effectively receive if the spot price in March is $0.0550 per pound? What if the spot price in March is $0.0590 per pound? Assume he is able to sell all 100,000 pounds. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts