Question: Question 6: Triangular arbitrage opportunity (16 marks) Assume you are a trader with ANZ. The following quotes became available to you. Type your ID number,

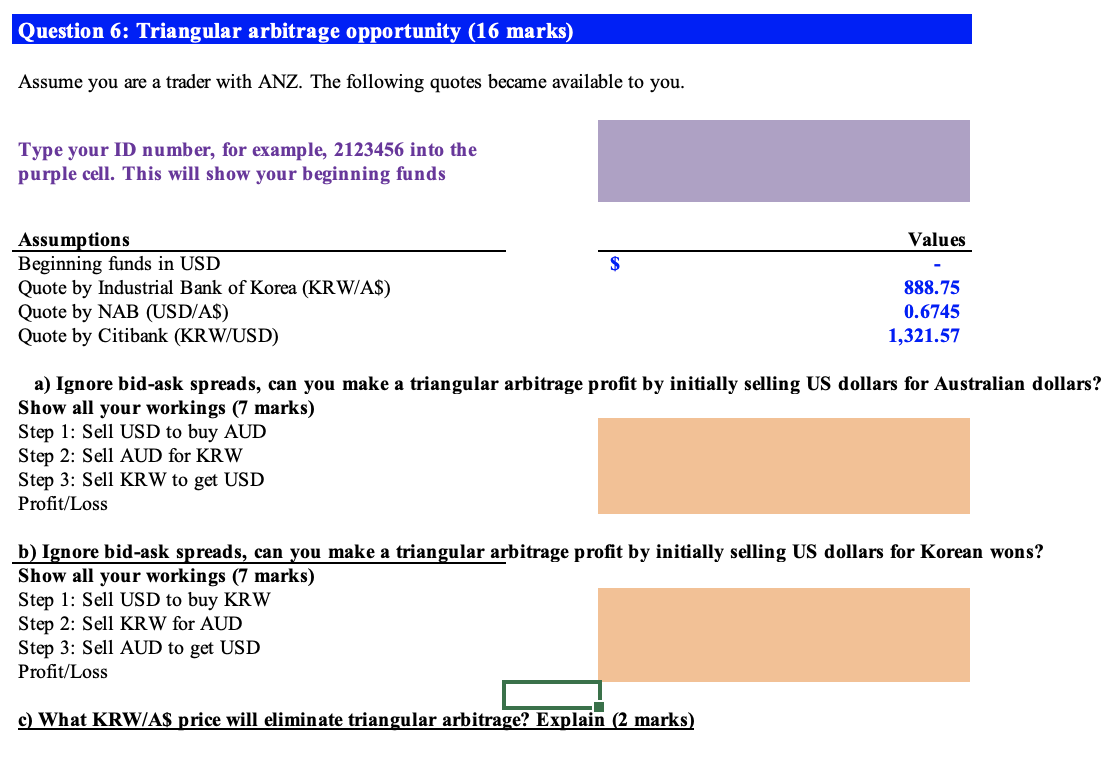

Question 6: Triangular arbitrage opportunity (16 marks) Assume you are a trader with ANZ. The following quotes became available to you. Type your ID number, for example, 2123456 into the purple cell. This will show your beginning funds Assumptions Values Beginning funds in USD Quote by Industrial Bank of Korea (KRW/A$) 888.75 Quote by NAB (USD/A$) 0.6745 Quote by Citibank (KRW/USD) 1,321.57 a) Ignore bid-ask spreads, can you make a triangular arbitrage profit by initially selling US dollars for Australian dollars? Show all your workings (7 marks) Step 1: Sell USD to buy AUD Step 2: Sell AUD for KR W Step 3: Sell KRW to get USD Profit/Loss b) Ignore bid-ask spreads, can you make a triangular arbitrage profit by initially selling US dollars for Korean wons? Show all your workings (7 marks) Step 1: Sell USD to buy KRW Step 2: Sell KRW for AUD Step 3: Sell AUD to get USD Profit/Loss c) What KRW/AS price will eliminate triangular arbitrage? Explain (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts