Question: question # 6 Under 1 8 3 , the IRS states that if a taxpayer can show a profit from an activity in any three

question #

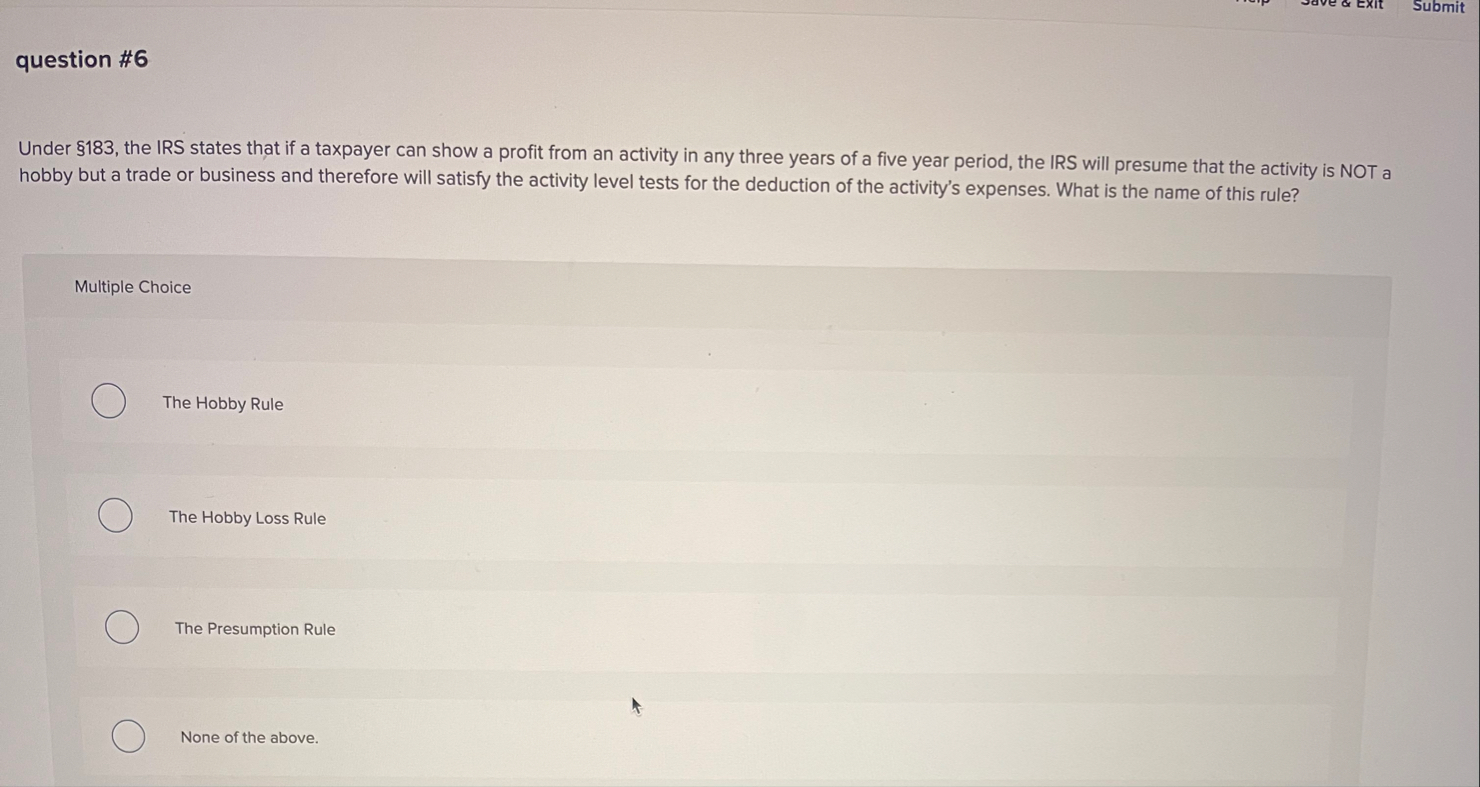

Under the IRS states that if a taxpayer can show a profit from an activity in any three years of a five year period, the IRS will presume that the activity is NOT a hobby but a trade or business and therefore will satisfy the activity level tests for the deduction of the activity's expenses. What is the name of this rule?

Multiple Choice

The Hobby Rule

The Hobby Loss Rule

The Presumption Rule

None of the above.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock