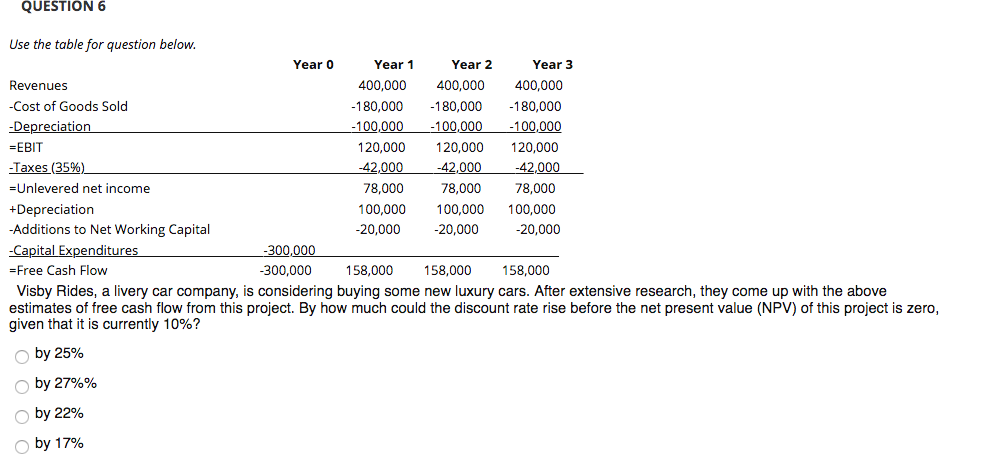

Question: QUESTION 6 Use the table for question below. Year o Year 1 Year 2 Year 3 Revenues 400,000 400,000 400,000 -Cost of Goods Sold -180,000

QUESTION 6 Use the table for question below. Year o Year 1 Year 2 Year 3 Revenues 400,000 400,000 400,000 -Cost of Goods Sold -180,000 -180,000 -180,000 -Depreciation -100,000 -100,000 -100,000 =EBIT 120,000 120,000 120,000 -Taxes (35%) -42,000 -42,000 -42,000 Unlevered net income 78,000 78,000 78,000 +Depreciation 100,000 100,000 100,000 -Additions to Net Working Capital -20,000 -20,000 -20,000 -Capital Expenditures -300,000 =Free Cash Flow -300,000 158,000 158,000 158,000 Visby Rides, a livery car company, is considering buying some new luxury cars. After extensive research, they come up with the above estimates of free cash flow from this project. By how much could the discount rate rise before the net present value (NPV) of this project is zero, given that it is currently 10%? by 25% by 27%% by 22% by 17%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts