Question: Question 6 You are given the following data on call and put premiums in pence per share for Company ABC shares which are currently priced

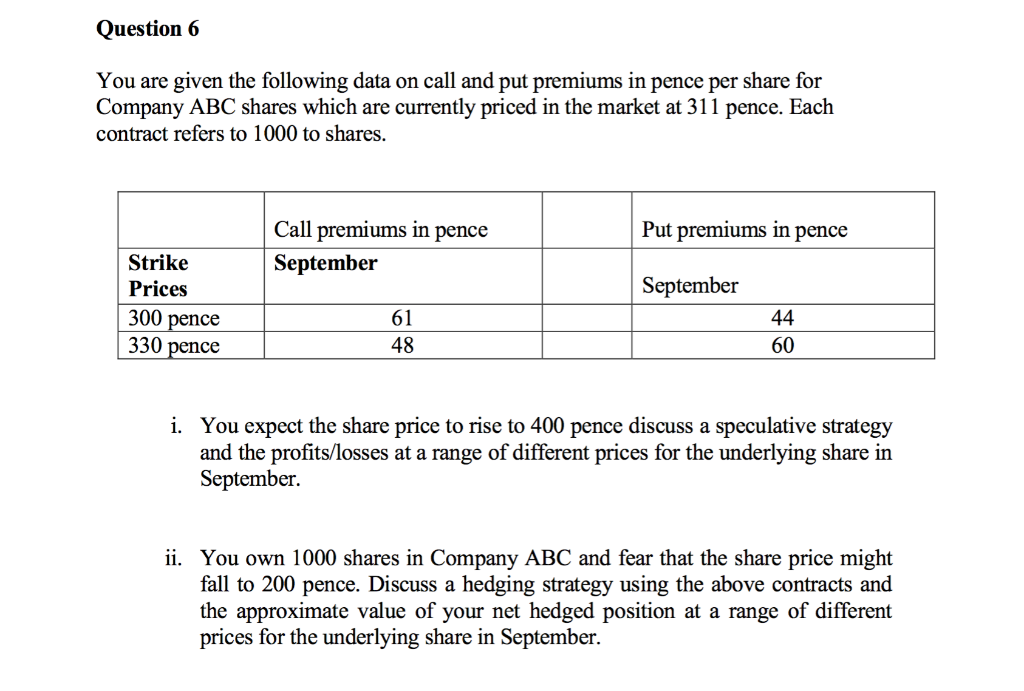

Question 6 You are given the following data on call and put premiums in pence per share for Company ABC shares which are currently priced in the market at 311 pence. Each contract refers to 1000 to shares. Put premiums in pence Call premiums in pence September September Strike Prices 300 pence 330 pence 61 48 44 60 i. You expect the share price to rise to 400 pence discuss a speculative strategy and the profits/losses at a range of different prices for the underlying share in September ii. You own 1000 shares in Company ABC and fear that the share price might fall to 200 pence. Discuss a hedging strategy using the above contracts and the approximate value of your net hedged position at a range of different prices for the underlying share in September

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts