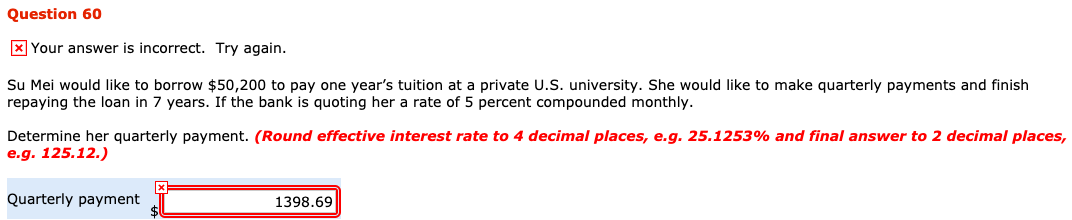

Question: Question 60 x Your answer is incorrect. Try again. Su Mei would like to borrow $50,200 to pay one year's tuition at a private U.S.

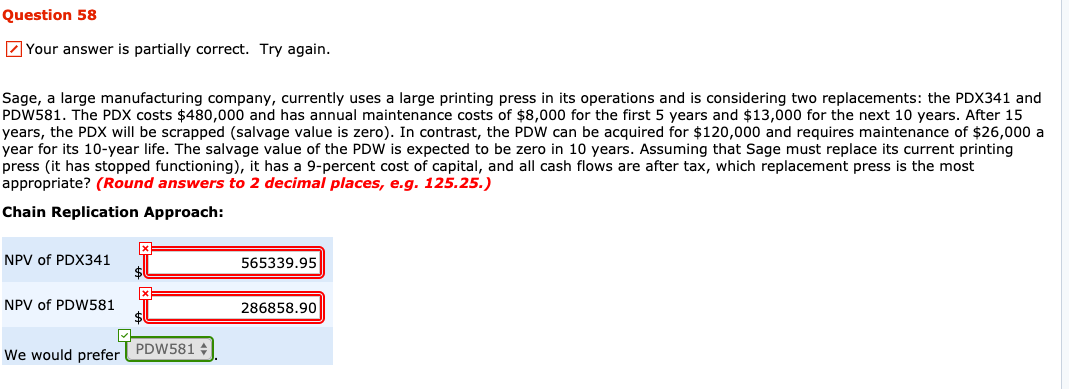

Question 60 x Your answer is incorrect. Try again. Su Mei would like to borrow $50,200 to pay one year's tuition at a private U.S. university. She would like to make quarterly payments and finish repaying the loan in 7 years. If the bank is quoting her a rate of 5 percent compounded monthly. Determine her quarterly payment. (Round effective interest rate to 4 decimal places, e.g. 25.1253% and final answer to 2 decimal places, e.g. 125.12.) Quarterly payment 1398.69 Question 58 Your answer is partially correct. Try again. Sage, a large manufacturing company, currently uses a large printing press in its operations and is considering two replacements: the PDX341 and PDW581. The PDX costs $480,000 and has annual maintenance costs of $8,000 for the first 5 years and $13,000 for the next 10 years. After 15 years, the PDX will be scrapped (salvage value is zero). In contrast, the PDW can be acquired for $120,000 and requires maintenance of $26,000 a year for its 10-year life. The salvage value of the PDW is expected to be zero in 10 years. Assuming that Sage must replace its current printing press (it has stopped functioning), it has a 9-percent cost of capital, and all cash flows are after tax, which replacement press is the most appropriate? (Round answers to 2 decimal places, e.g. 125.25.) Chain Replication Approach: NPV of PDX341 565339.95 NPV of PDW581 286858.90 We would prefer PDW581

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts