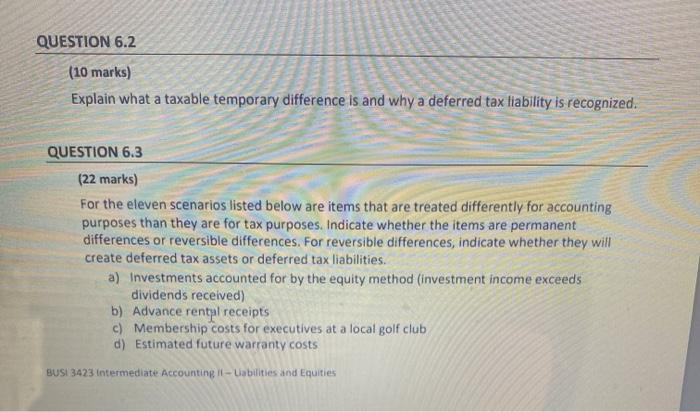

Question: QUESTION 6.2 (10 marks) Explain what a taxable temporary difference is and why a deferred tax liability is recognized. QUESTION 6.3 (22 marks) For the

QUESTION 6.2 (10 marks) Explain what a taxable temporary difference is and why a deferred tax liability is recognized. QUESTION 6.3 (22 marks) For the eleven scenarios listed below are items that are treated differently for accounting purposes than they are for tax purposes. Indicate whether the items are permanent differences or reversible differences. For reversible differences, indicate whether they will create deferred tax assets or deferred tax liabilities. a) Investments accounted for by the equity method (investment income exceeds dividends received) b) Advance rental receipts c) Membership costs for executives at a local golf club d) Estimated future warranty costs BUSI 3423 Intermediate Accounting Il-abilities and Equities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts