Question: QUESTION 65 10 points Save Answer Please select at least two activity measures you have already calculated for the organization. In the box below, please

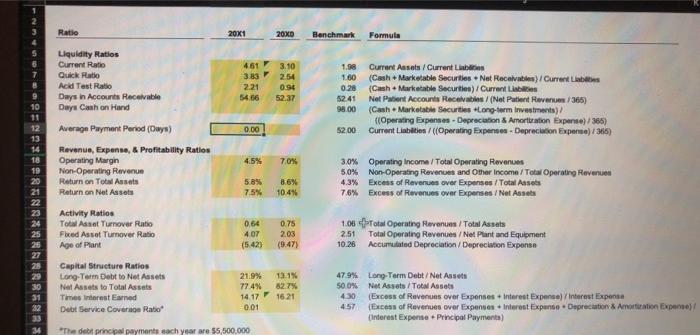

QUESTION 65 10 points Save Answer Please select at least two activity measures you have already calculated for the organization. In the box below, please apply the framework we reviewed in class and discuss your findings with respect to the following: Year-over-year trending Performance against benchmark Drivers of change in the metric and management considerations for improvement For the toolbar, press ALT F10 PC) or ALT+FN:F10 Mach B TUS Paragraph Arial 14px A21 x x 82 . 1992. FR ( ) V 07 [+ ili r D Ratio 20X1 20XD Benchmark Formula Liquidity Ratios Current Ratio Quick Ratio Acid Test Ratio Days in Accounts Receivable Days Cash on Hand Average Payment Period (Days) 461 3.10 3.83 2.54 2.21 0.94 54.06 52.37 1.98 160 0.28 5241 98.00 Current Assets / Current Labs (Cash Marketable Securities .Net Receivable) / Current Labs (Cash Marketable Securitie) / Current Lisbies Net Patient Accounts Receivables /(Net Patient Reverse/365) (Cash Marketable Securities Long-term investments) Operating Expenses - Depreciation & Amortation Expanse)/365) Current Liabilities/((Operating Expenses. Depreciation Expense)/365) 0.00 5200 8 9 10 11 12 13 14 18 19 20 21 4.5% 70% Revenue, Expense & Profitability Ratios Operating Margin Non-Operating Ravenue Return on Total Assets Return on Net Assets 5.8% 75% 8.6% 10.4% 3,0% Operating Income Total Operating Revenues 5,0% Non Operating Revenues and Other Income / Total Operating Revenuen 4.3% Excess of Revenues over Expenses/Total Assets 7.6% Excess of Revenues over Expenses / Net Assets Activity Ratios Total Asset Turnover Ratio Fred Asset Turnover Ratio Age of Plant 0.64 407 (5.42) 0.75 2.03 1.00 Total Operating Revenues / Total Assets 2.51 Total Operating Revenues / Net Plant and Equipment 10.26 Accumulated Depreciation / Depreciation Expense 23 24 25 26 27 28 29 30 31 32 33 Capital Structure Ratios Long-Term Debt to Net Assets Nel Assets to Total Assets Times Interest Emned Debt Service Coverage Ratio 21.9% 77.4% 14.17 0.01 13.1% 82.7% 16.21 47 9% Long-Term Debt/Net Assets 50.0% Net Assets/Total Assets 430 (Excess of Revenues over Expenses Interest Expense) interest Expense 4.57 Excess of Revenues over Expenses Interest Expense Depreciation & Amortation Expenses (Interest Expense. Principal Payments) "The debt principal payments each year are 55,500,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts