Question: Question 7 0.5 pts Mark is offering you a call option contract on KO at a price of 6. He mentions that the strike price

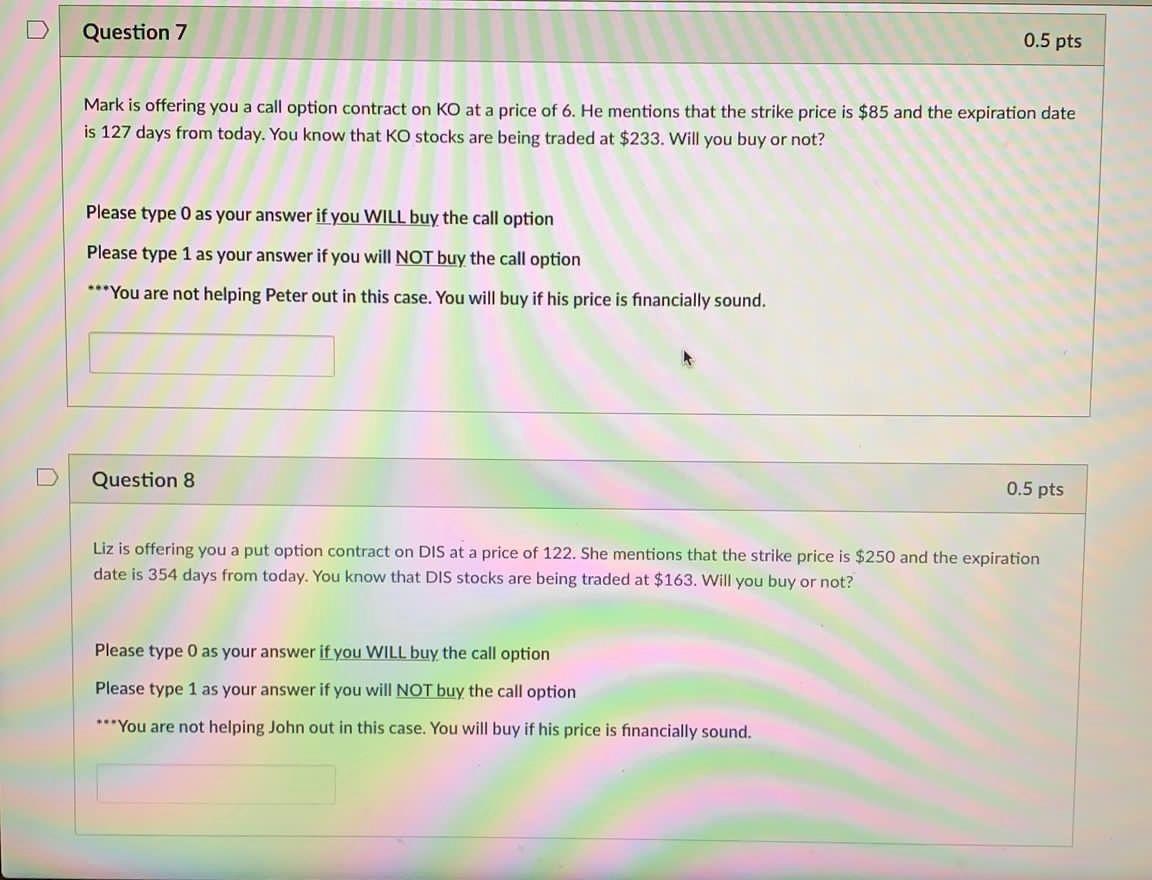

Question 7 0.5 pts Mark is offering you a call option contract on KO at a price of 6. He mentions that the strike price is $85 and the expiration date is 127 days from today. You know that KO stocks are being traded at $233. Will you buy or not? Please type 0 as your answer if you WILL buy the call option Please type 1 as your answer if you will NOT buy the call option ***You are not helping Peter out in this case. You will buy if his price is financially sound. Question 8 0.5 pts Liz is offering you a put option contract on DIS at a price of 122. She mentions that the strike price is $250 and the expiration date is 354 days from today. You know that DIS stocks are being traded at $163. Will you buy or not? Please type 0 as your answer if you WILL buy the call option Please type 1 as your answer if you will NOT buy the call option ***You are not helping John out in this case. You will buy if his price is financially sound

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts