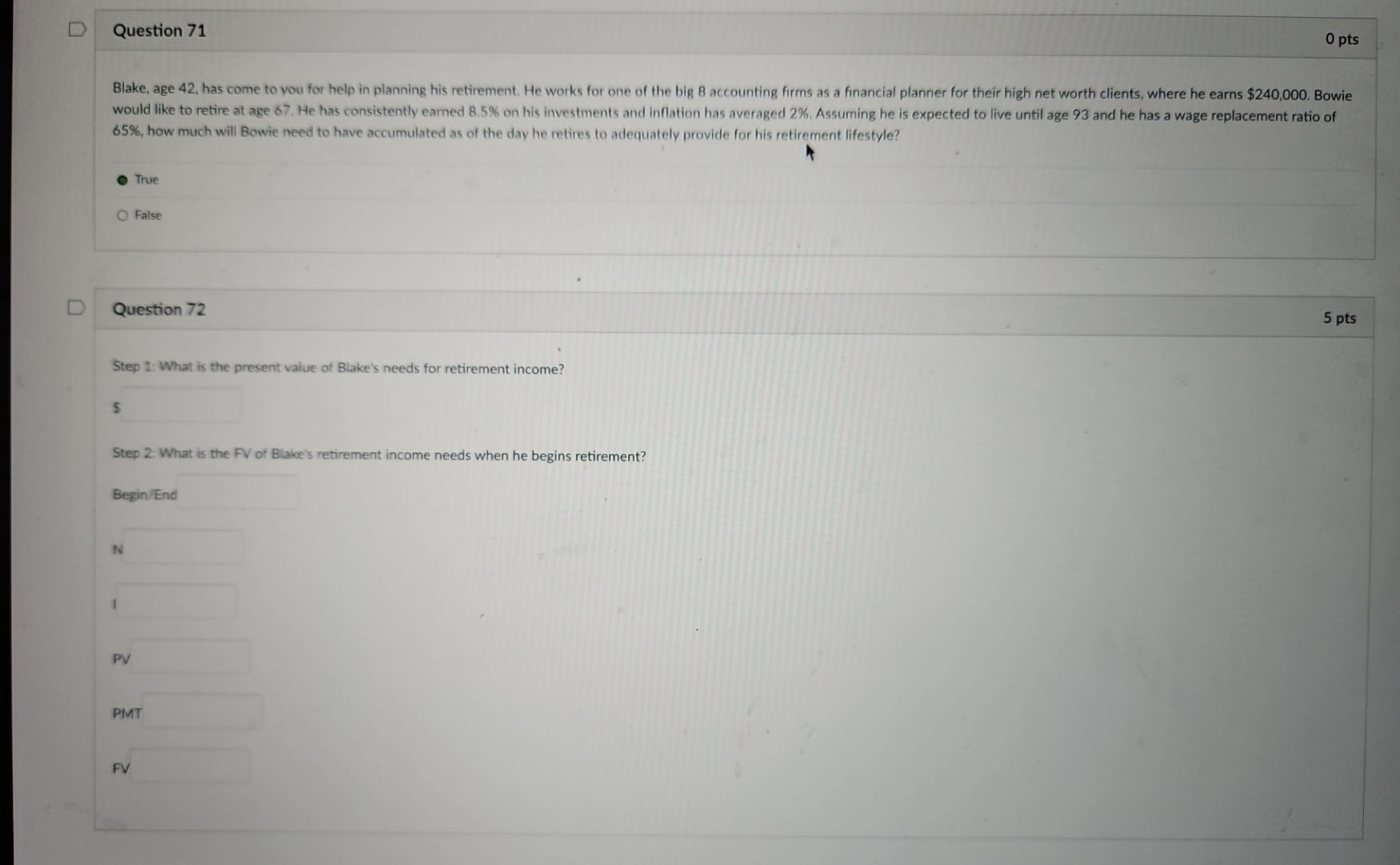

Question: Question 7 1 0 pts Blake, age 4 2 , has come to you for help in planning his retirement. He works for one of

Question

pts

Blake, age has come to you for help in planning his retirement. He works for one of the big accounting firms as a financial planner for their high net worth clients, where he earns $ Bowie would like to retire at age He has consistently earned on his investments and inflation has averaged Assuming he is expected to live until age and he has a wage replacement ratio of how much will Bowie need to have accumulated as of the day he retires to adequately provide for his retirement lifestyle?

True

Fatse

Question

pts

Step : What is the present value of Blake's needs for retirement income?

Step : What is the FV of Blake's retirement income needs when he begins retirement?

BeginEnc

PV

PIM

FV

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock