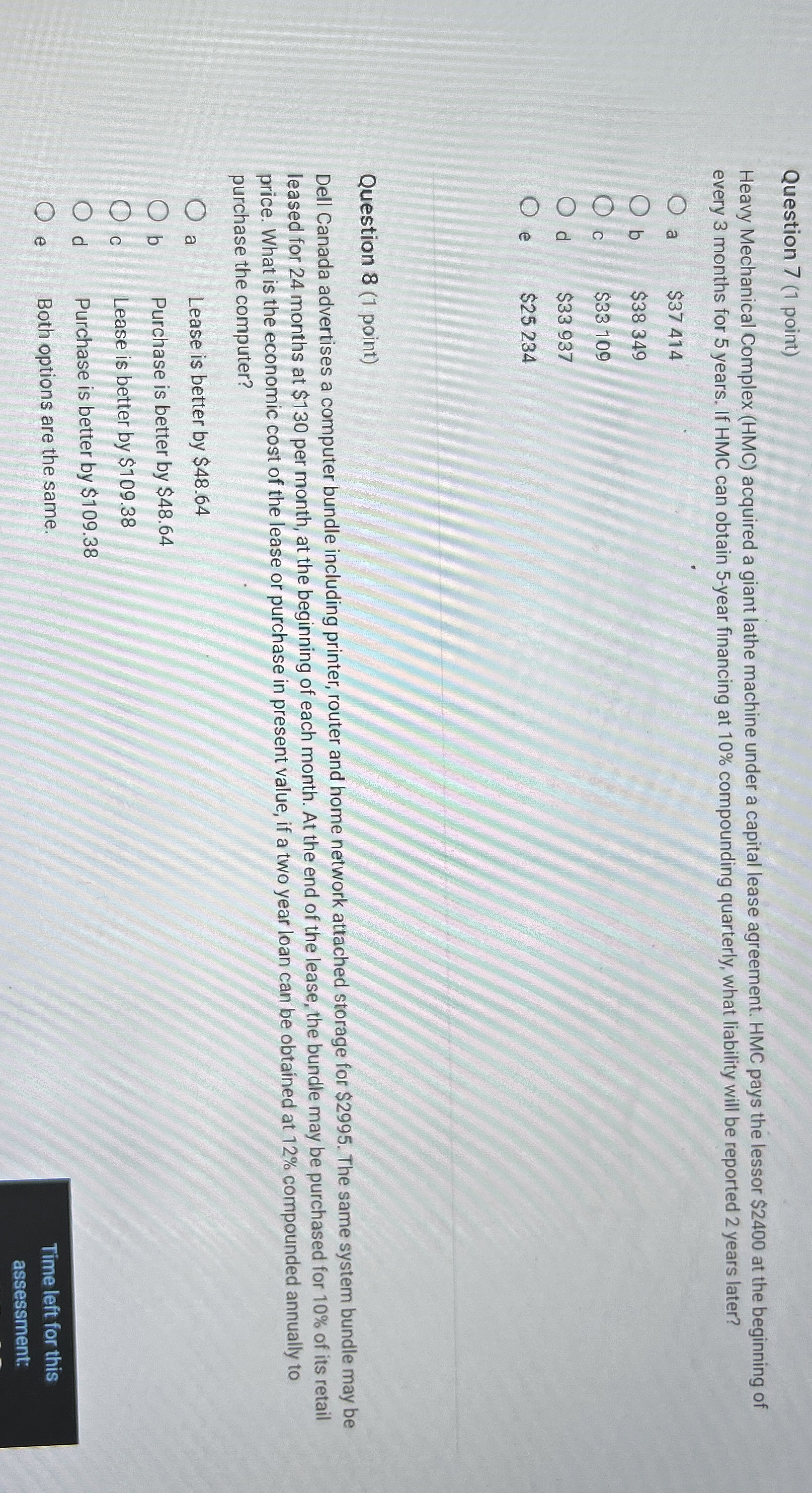

Question: Question 7 ( 1 point ) Heavy Mechanical Complex ( HMC ) acquired a giant lathe machine under a capital lease agreement. HMC pays the

Question point

Heavy Mechanical Complex HMC acquired a giant lathe machine under a capital lease agreement. HMC pays the lessor $ at the beginning of every months for years. If HMC can obtain year financing at compounding quarterly, what liability will be reported years later?

a $

b $

c $

d $

e $

Question point

Dell Canada advertises a computer bundle including printer, router and home network attached storage for $ The same system bundle may be leased for months at $ per month, at the beginning of each month. At the end of the lease, the bundle may be purchased for of its retail price. What is the economic cost of the lease or purchase in present value, if a two year loan can be obtained at compounded annually to purchase the computer?

a Lease is better by $

b Purchase is better by $

c Lease is better by $

d Purchase is better by $

e Both options are the same.

Time left for this

assessment:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock