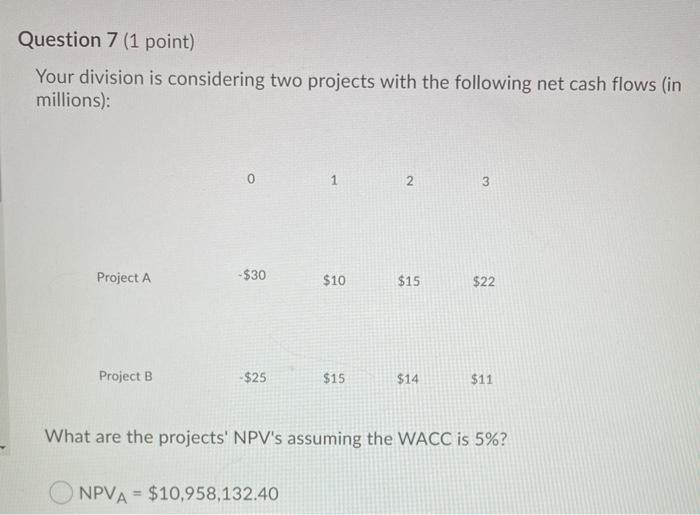

Question: Question 7 (1 point) Your division is considering two projects with the following net cash flows (in millions): 0 2 3 Project A -$30 $10

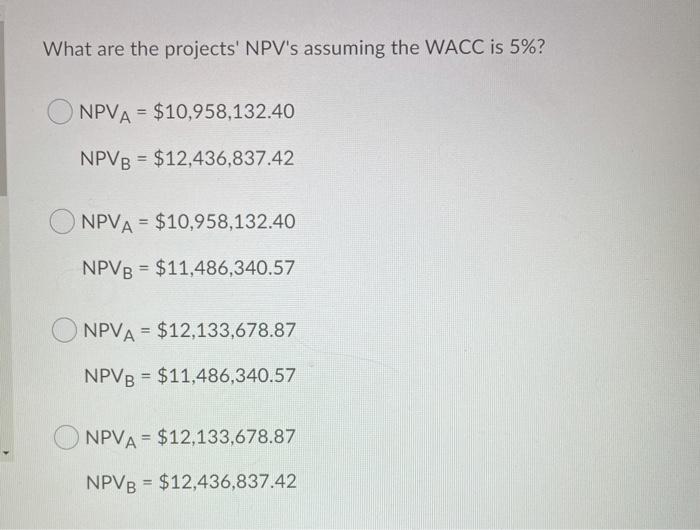

Question 7 (1 point) Your division is considering two projects with the following net cash flows (in millions): 0 2 3 Project A -$30 $10 $15 $22 Project B - $25 $15 $14 $11 What are the projects' NPV's assuming the WACC is 5%? NPVA = $10,958,132.40 What are the projects' NPV's assuming the WACC is 5%? NPVA = $10,958,132.40 NPVB = $12,436,837.42 NPVA = $10,958,132.40 NPVB = $11,486,340.57 NPVA = $12,133,678.87 NPVB = $11,486,340.57 NPVA = $12,133,678.87 NPVB = $12,436,837.42

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts