Question: QUESTION 7 1 points Save Answer 10 years ago ABC corporation issued a 20-year bond with $1000 par value, semiannual coupon payment, 10% coupon rate

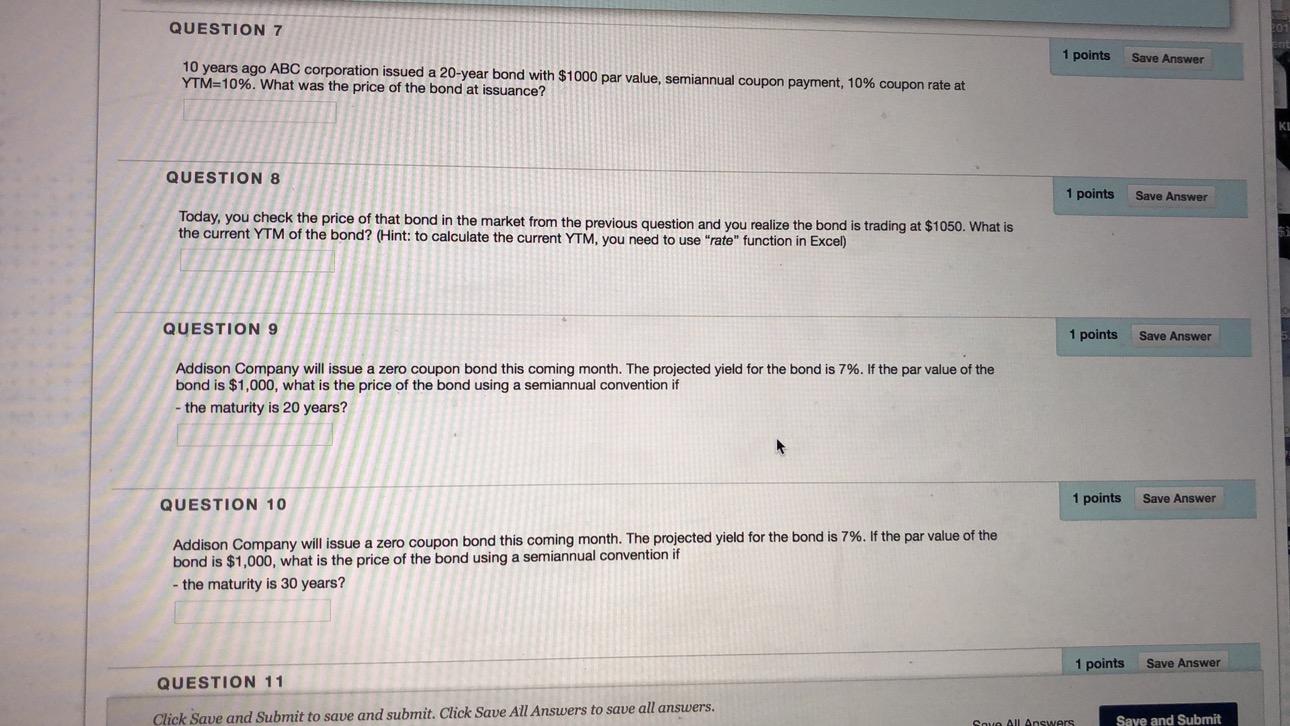

QUESTION 7 1 points Save Answer 10 years ago ABC corporation issued a 20-year bond with $1000 par value, semiannual coupon payment, 10% coupon rate at YTM=10%. What was the price of the bond at issuance? KI QUESTION 8 1 points Save Answer Today, you check the price of that bond in the market from the previous question and you realize the bond is trading at $1050. What is the current YTM of the bond? (Hint: to calculate the current YTM, you need to use "rate" function in Excel) QUESTION 9 1 points Save Answer Addison Company will issue a zero coupon bond this coming month. The projected yield for the bond is 7%. If the par value of the bond is $1,000, what is the price of the bond using semiannual convention if the maturity is 20 years? QUESTION 10 1 points Save Answer Addison Company will issue a zero coupon bond this coming month. The projected yield for the bond is 7%. If the par value of the bond is $1,000, what is the price of the bond using a semiannual convention if - the maturity is 30 years? 1 points Save Answer QUESTION 11 Click Save and Submit to save and submit. Click Save All Answers to save all answers. Sovo All Answers Save and Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts