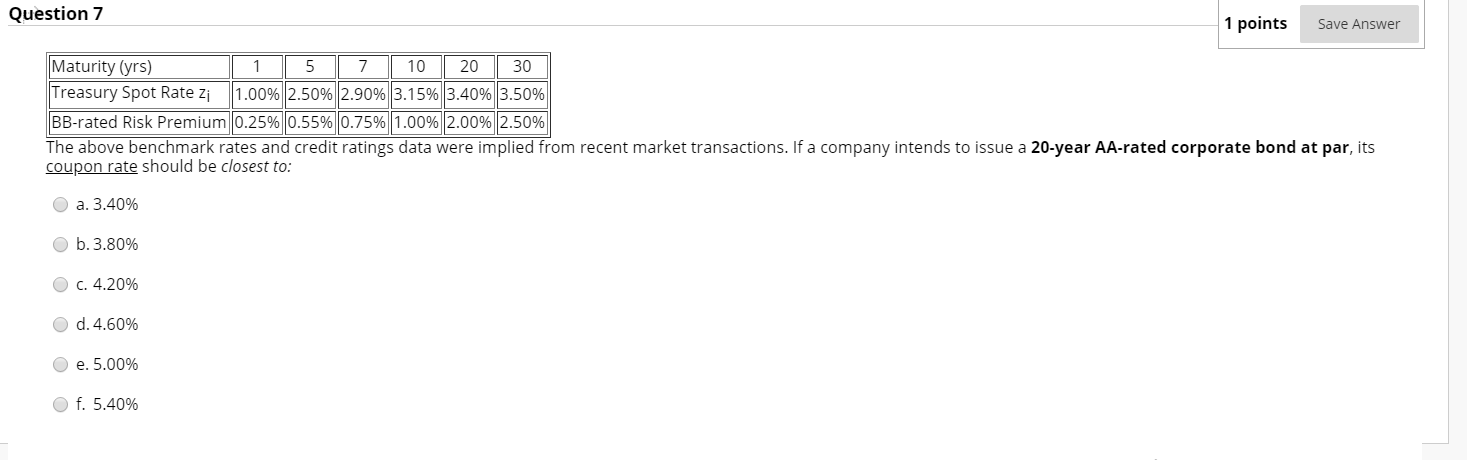

Question: Question 7 1 points Save Answer 5 Maturity (yrs) 1 7 10 20 30 Treasury Spot Rate zi 1.00% 2.50% 2.90%3.15% 3.40% 3.50% BB-rated Risk

Question 7 1 points Save Answer 5 Maturity (yrs) 1 7 10 20 30 Treasury Spot Rate zi 1.00% 2.50% 2.90%3.15% 3.40% 3.50% BB-rated Risk Premium 0.25% 0.55% 0.75% 1.00% 2.00% 2.50% The above benchmark rates and credit ratings data were implied from recent market transactions. If a company intends to issue a 20-year AA-rated corporate bond at par, its coupon rate should be closest to: O a. 3.40% O b. 3.80% C. 4.20% O d. 4.60% O e. 5.00% O f. 5.40%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts