Question: Question 7 1 points Save Answer Use the information for the question(s) below. Consider two firms, With and Without, that have identical assets that generate

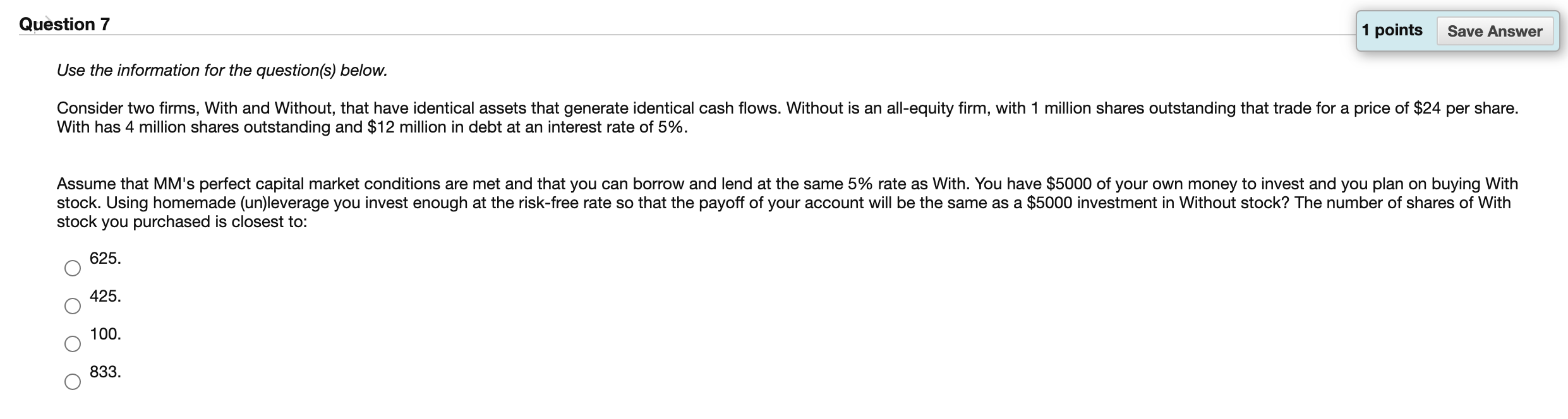

Question 7 1 points Save Answer Use the information for the question(s) below. Consider two firms, With and Without, that have identical assets that generate identical cash flows. Without is an all-equity firm, with 1 million shares outstanding that trade for a price of $24 per share. With has 4 million shares outstanding and $12 million in debt at an interest rate of 5%. Assume that MM's perfect capital market conditions are met and that you can borrow and lend at the same 5% rate as With. You have $5000 of your own money to invest and you plan on buying With stock. Using homemade (un)leverage you invest enough at the risk-free rate so that the payoff of your account will be the same as a $5000 investment in Without stock? The number of shares of With stock you purchased is closest to: 625. 425. 100. 833

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts