Question: Question 7 1 pts A project you're considering involves a working capital expenditure of $1,000 immediately as well as an additional $1,000 working capital expenditure

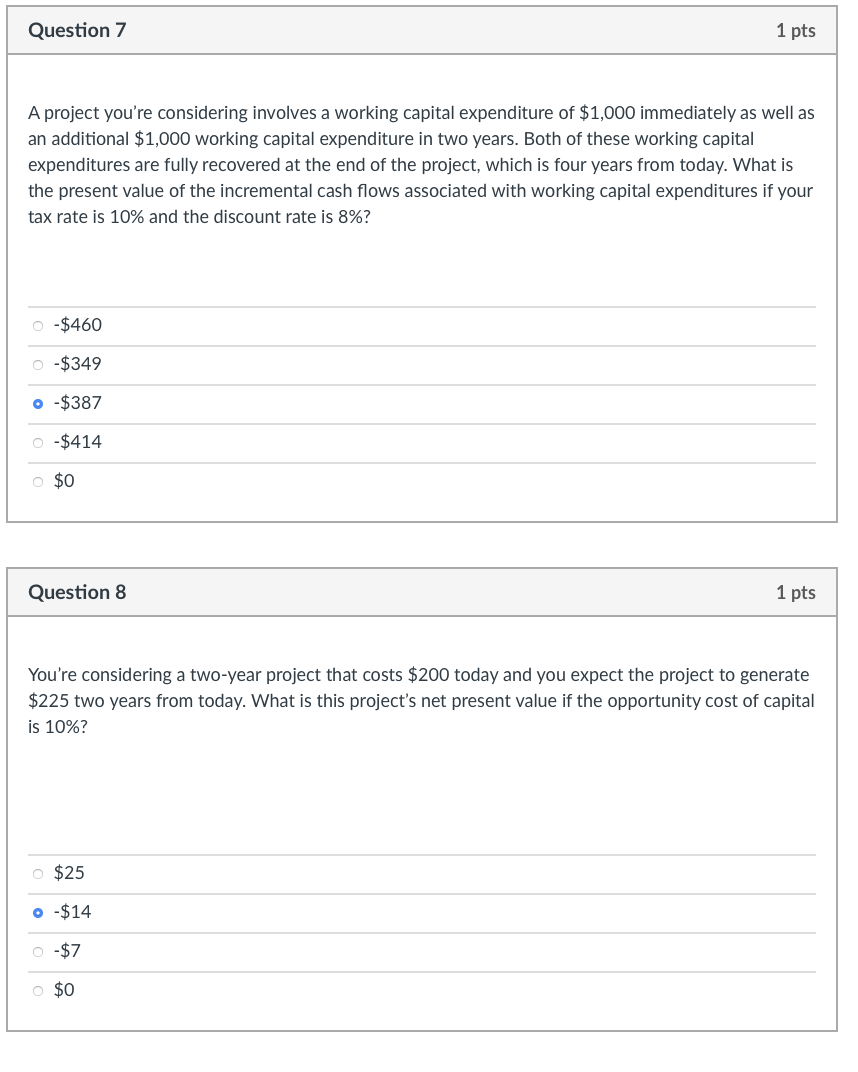

Question 7 1 pts A project you're considering involves a working capital expenditure of $1,000 immediately as well as an additional $1,000 working capital expenditure in two years. Both of these working capital expenditures are fully recovered at the end of the project, which is four years from today. What is the present value of the incremental cash flows associated with working capital expenditures if your tax rate is 10% and the discount rate is 8%? O $460 O-$349 O $387 -$414 O $0 Question 8 1 pts You're considering a two-year project that costs $200 today and you expect the project to generate $225 two years from today. What is this project's net present value if the opportunity cost of capital is 10%? o $25 o $14 O $7 O $0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts