Question: Question 7 1 pts Given the following data, what is the proposal's NPV and should the machine be purchased (non-tax paying entity)? Existing equipment to

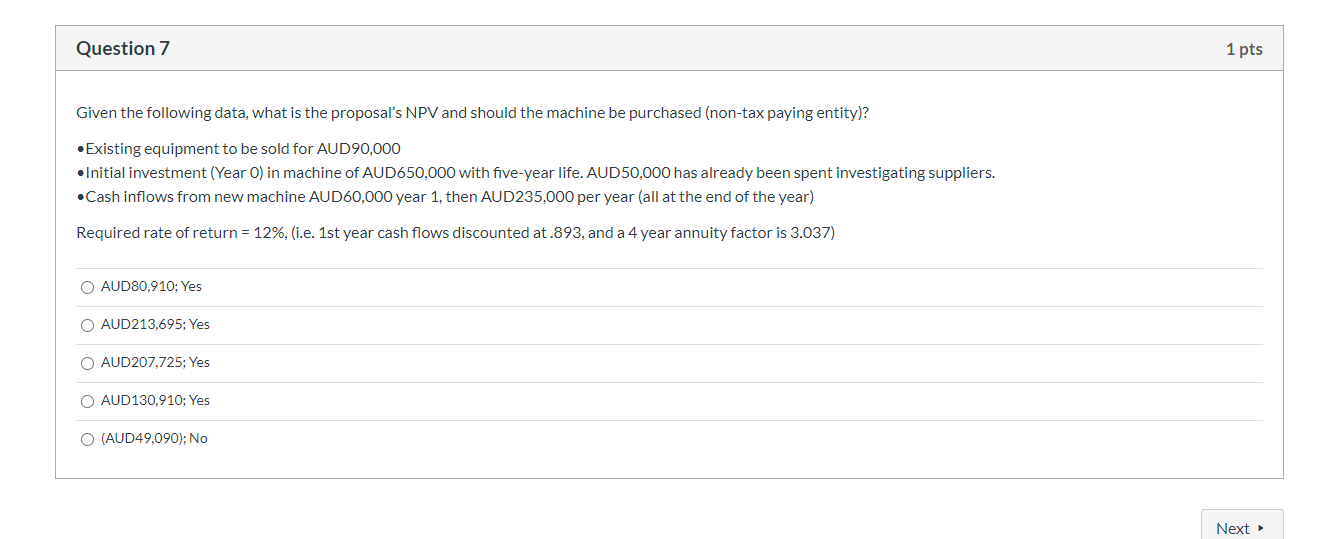

Question 7 1 pts Given the following data, what is the proposal's NPV and should the machine be purchased (non-tax paying entity)? Existing equipment to be sold for AUD90,000 Initial investment (Year 0) in machine of AUD650,000 with five-year life. AUD50,000 has already been spent investigating suppliers. Cash inflows from new machine AUD60,000 year 1, then AUD235,000 per year (all at the end of the year) Required rate of return = 12%, (i.e. 1st year cash flows discounted at.893, and a 4 year annuity factor is 3.037) O AUD80,910; Yes O AUD213,695: Yes O AUD207.725: Yes O AUD130,910; Yes O (AUD49,090); No Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock