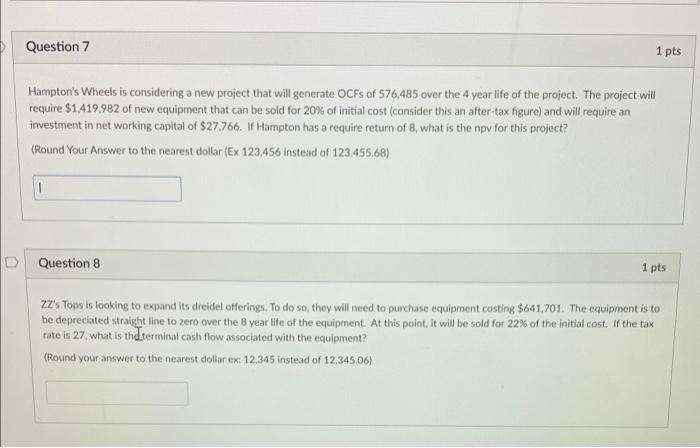

Question: Question 7 1 pts Hampton's Wheels is considering a new project that will generate OCFs of 576,485 over the 4 year life of the project.

Question 7 1 pts Hampton's Wheels is considering a new project that will generate OCFs of 576,485 over the 4 year life of the project. The project will require $1.419,982 of new equipment that can be sold for 20% of initial cost consider this an after-tax figure) and will require an investment in net working capital of $27,766. If Hampton has a require return of 8, what is the apy for this project? (Round Your Answer to the nearest dollar (Ex 123,456 Instead of 123.455.68) Question 8 1 pts ZZ's Tops is looking to expand its dreidel offerings. To do so, they will need to purchase equipment costing $641,701. The equipment is to be depreciated straight line to zero over the 8 year life of the equipment. At this point, it will be sold for 22% of the initial cost. If the tax rate is 27, what is the terminal cash flow associated with the equipment? (Round your answer to the nearest dollar ex: 12,345 instead of 12,345.06)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts