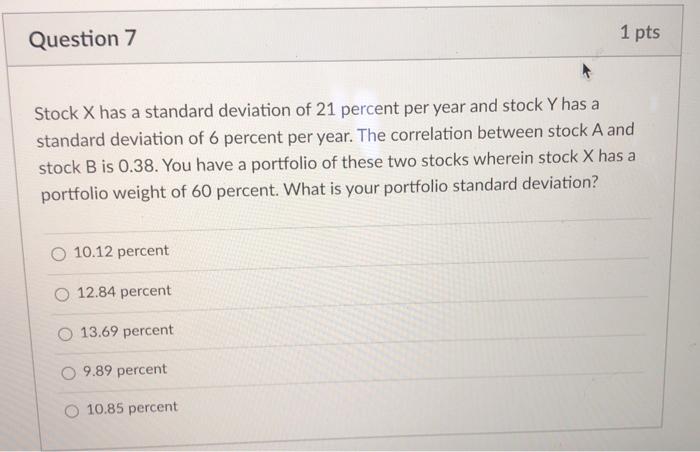

Question: Question 7 1 pts Stock X has a standard deviation of 21 percent per year and stock Y has a standard deviation of 6 percent

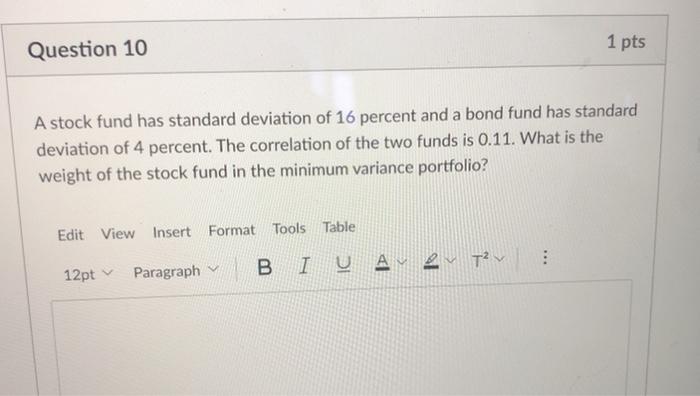

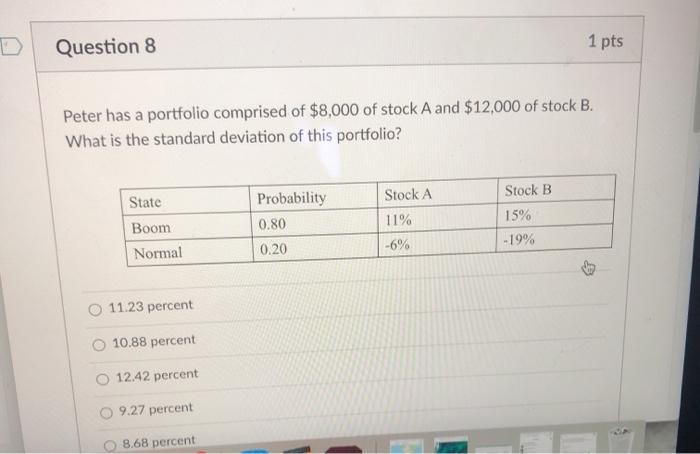

Question 7 1 pts Stock X has a standard deviation of 21 percent per year and stock Y has a standard deviation of 6 percent per year. The correlation between stock A and stock B is 0.38. You have a portfolio of these two stocks wherein stock X has a portfolio weight of 60 percent. What is your portfolio standard deviation? 10.12 percent 12.84 percent 13.69 percent 9.89 percent O 10.85 percent Question 10 1 pts A stock fund has standard deviation of 16 percent and a bond fund has standard deviation of 4 percent. The correlation of the two funds is 0.11. What is the weight of the stock fund in the minimum variance portfolio? Edit View Insert Format Tools Table T Paragraph 12pt Question 8 1 pts Peter has a portfolio comprised of $8,000 of stock A and $12,000 of stock B. What is the standard deviation of this portfolio? Stock A State Boom Normal Probability 0.80 0.20 11% -6% Stock B 15% -19% 11.23 percent 10.88 percent 12.42 percent 9.27 percent 8.68 percent 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts