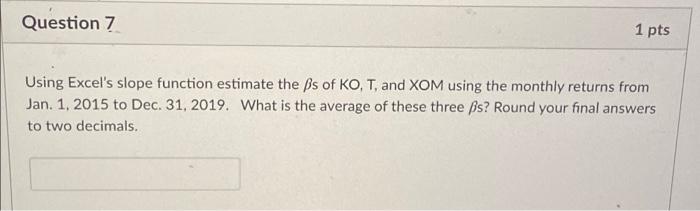

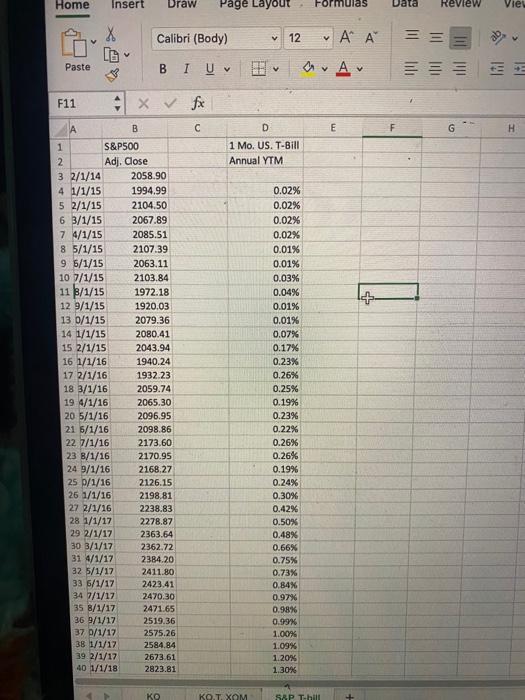

Question: Question 7 1 pts Using Excel's slope function estimate the ps of KO, T, and XOM using the monthly returns from Jan. 1. 2015 to

Question 7 1 pts Using Excel's slope function estimate the ps of KO, T, and XOM using the monthly returns from Jan. 1. 2015 to Dec 31, 2019. What is the average of these three ps? Round your final answers to two decimals. Home Insert Draw Page Layout Formulas Data Review Viey X Calibri (Body) 12 V ' ' == v Paste BIU V GA v === F11 x x -- B D E H 1 Mo. US. T-Bill Annual YTM 1 S&P500 2 Adj. Close 3 2/1/14 2058.90 4 1/1/15 1994.99 5 2/1/15 2104.50 6 3/1/15 2067.89 7 4/1/15 2085.51 8 5/1/15 2107.39 9 6/1/15 2063.11 10 7/1/15 2103.84 11 B/1/15 1972.18 12 9/1/15 1920.03 13 0/1/15 2079.36 14 1/1/15 2080.41 15 2/1/15 2043.94 16 1/1/16 1940.24 17 2/1/16 1932.23 18 3/1/16 2059.74 19 4/1/16 2065.30 20 5/1/16 2096.95 21 5/1/16 2098.86 22 7/1/16 2173.60 23 B/1/16 2170.95 24 9/1/16 2168.27 25 p/1/16 2126.15 26 1/1/16 2198.81 27 2/1/16 2238.83 28 1/1/17 2278.87 29 2/1/17 2363.64 30 3/1/17 2362.72 31 4/1/17 23B4.20 32 5/1/17 2411.80 33 6/1/17 2423.41 34 7/1/17 2470.30 35 8/1/17 2471.65 36 9/1/17 2519.36 37 0/1/17 2575.26 38 1/1/17 2584.84 39 2/1/17 2673.61 40 1/1/18 2823.81 0.02% 0.02% 0.02% 0.02% 0.01% 0.01% 0.03% 0.04% 0.01% 0.01% 0.07% 0.17% 0.23% 0.26% 0.25% 0.19% 0.23% 0.22% 0.26% 0.26% 0.19% 0.24% 0.30% 0.42% 0.50% 0.48% 0.66% 0.75% 0.73% 0.84% 0.97% 0.98% 0.99% 1.00% 1.09% 1.20% 1.30% KO KOTXOM SRPT hill Calibri (Body) 12 V v ' = X LG Paste BIU v a. Av v = = = F11 Ax fx A D E F G JO UJU 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 214727 10/1/17 11/1/17 12/1/17 1/1/18 2/1/18 3/1/18 4/1/18 5/1/18 6/1/18 7/1/18 8/1/18 9/1/18 10/1/18 11/1/18 12/1/18 1/1/19 2/1/19 3/1/19 4/1/19 5/1/19 6/1/19 7/1/19 8/1/19 9/1/19 10/1/19 11/1/19 12/1/19 B LJU 2575.26 2584.84 2673.61 2823.81 2713.83 2640.87 2648.05 2705.27 2718.37 2816.29 2901.52 2913.98 2711.74 2760.17 2506.85 2704.10 2784.49 2834.40 2945.83 2752.06 2941.76 2980.38 2926.46 2976.74 3037.56 3140.98 3230.78 1.00% 1.09% 1.20% 1.30% 1.38% 1.64% 1.66% 1.71% 1.81% 1.89% 1.94% 2.04% 2.17% 2.24% 2.37% 2.40% 2.43% 2.45% 2.43% 2.40% 2.22% 2.15% 2.07% 1.99% 1.73% 1.58% 1.55% + Question 7 1 pts Using Excel's slope function estimate the ps of KO, T, and XOM using the monthly returns from Jan. 1. 2015 to Dec 31, 2019. What is the average of these three ps? Round your final answers to two decimals. Home Insert Draw Page Layout Formulas Data Review Viey X Calibri (Body) 12 V ' ' == v Paste BIU V GA v === F11 x x -- B D E H 1 Mo. US. T-Bill Annual YTM 1 S&P500 2 Adj. Close 3 2/1/14 2058.90 4 1/1/15 1994.99 5 2/1/15 2104.50 6 3/1/15 2067.89 7 4/1/15 2085.51 8 5/1/15 2107.39 9 6/1/15 2063.11 10 7/1/15 2103.84 11 B/1/15 1972.18 12 9/1/15 1920.03 13 0/1/15 2079.36 14 1/1/15 2080.41 15 2/1/15 2043.94 16 1/1/16 1940.24 17 2/1/16 1932.23 18 3/1/16 2059.74 19 4/1/16 2065.30 20 5/1/16 2096.95 21 5/1/16 2098.86 22 7/1/16 2173.60 23 B/1/16 2170.95 24 9/1/16 2168.27 25 p/1/16 2126.15 26 1/1/16 2198.81 27 2/1/16 2238.83 28 1/1/17 2278.87 29 2/1/17 2363.64 30 3/1/17 2362.72 31 4/1/17 23B4.20 32 5/1/17 2411.80 33 6/1/17 2423.41 34 7/1/17 2470.30 35 8/1/17 2471.65 36 9/1/17 2519.36 37 0/1/17 2575.26 38 1/1/17 2584.84 39 2/1/17 2673.61 40 1/1/18 2823.81 0.02% 0.02% 0.02% 0.02% 0.01% 0.01% 0.03% 0.04% 0.01% 0.01% 0.07% 0.17% 0.23% 0.26% 0.25% 0.19% 0.23% 0.22% 0.26% 0.26% 0.19% 0.24% 0.30% 0.42% 0.50% 0.48% 0.66% 0.75% 0.73% 0.84% 0.97% 0.98% 0.99% 1.00% 1.09% 1.20% 1.30% KO KOTXOM SRPT hill Calibri (Body) 12 V v ' = X LG Paste BIU v a. Av v = = = F11 Ax fx A D E F G JO UJU 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 214727 10/1/17 11/1/17 12/1/17 1/1/18 2/1/18 3/1/18 4/1/18 5/1/18 6/1/18 7/1/18 8/1/18 9/1/18 10/1/18 11/1/18 12/1/18 1/1/19 2/1/19 3/1/19 4/1/19 5/1/19 6/1/19 7/1/19 8/1/19 9/1/19 10/1/19 11/1/19 12/1/19 B LJU 2575.26 2584.84 2673.61 2823.81 2713.83 2640.87 2648.05 2705.27 2718.37 2816.29 2901.52 2913.98 2711.74 2760.17 2506.85 2704.10 2784.49 2834.40 2945.83 2752.06 2941.76 2980.38 2926.46 2976.74 3037.56 3140.98 3230.78 1.00% 1.09% 1.20% 1.30% 1.38% 1.64% 1.66% 1.71% 1.81% 1.89% 1.94% 2.04% 2.17% 2.24% 2.37% 2.40% 2.43% 2.45% 2.43% 2.40% 2.22% 2.15% 2.07% 1.99% 1.73% 1.58% 1.55% +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts