Question: Question 7 1 pts You are preparing a pro forma cash flow statement for a small multi-family building you are considering buying and holding for

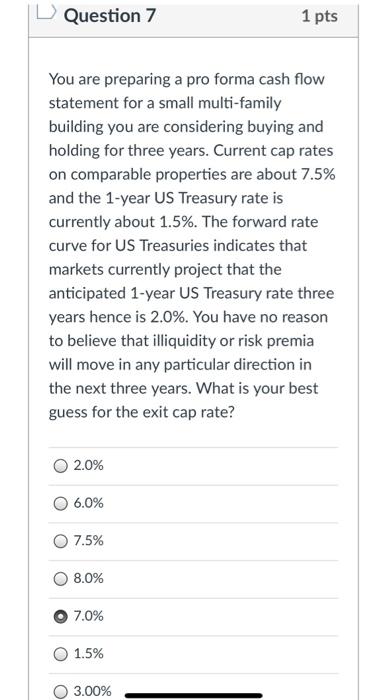

Question 7 1 pts You are preparing a pro forma cash flow statement for a small multi-family building you are considering buying and holding for three years. Current cap rates on comparable properties are about 7.5% and the 1-year US Treasury rate is currently about 1.5%. The forward rate curve for US Treasuries indicates that markets currently project that the anticipated 1-year US Treasury rate three years hence is 2.0%. You have no reason to believe that illiquidity or risk premia will move in any particular direction in the next three years. What is your best guess for the exit cap rate? 2.0% 6.0% 7.5% 8.0% 7.0% 1.5% 3.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts