Question: Question 7 (10 points) Listen In applying M&M Proposition I with no tax, which of the following is correct? 1) the debt-equity ratio of a

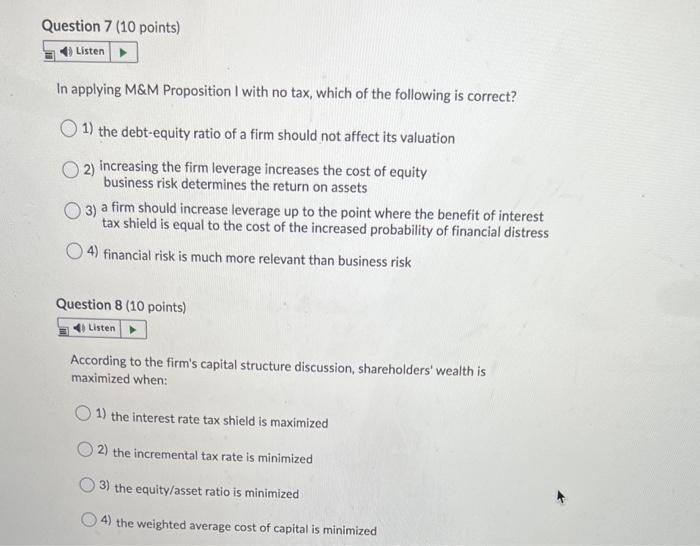

Question 7 (10 points) Listen In applying M&M Proposition I with no tax, which of the following is correct? 1) the debt-equity ratio of a firm should not affect its valuation O2) increasing the firm leverage increases the cost of equity business risk determines the return on assets 3) a firm should increase leverage up to the point where the benefit of interest tax shield is equal to the cost of the increased probability of financial distress O4) financial risk is much more relevant than business risk Question 8 (10 points) Listen According to the firm's capital structure discussion, shareholders' wealth is maximized when: 1) the interest rate tax shield is maximized 2) the incremental tax rate is minimized 3) the equity/asset ratio is minimized 4) the weighted average cost of capital is minimized

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts