Question: QUESTION 7 10 points Save Answer Your father is about to retire, and he wants to buy an annuity that will provide him with $100,000

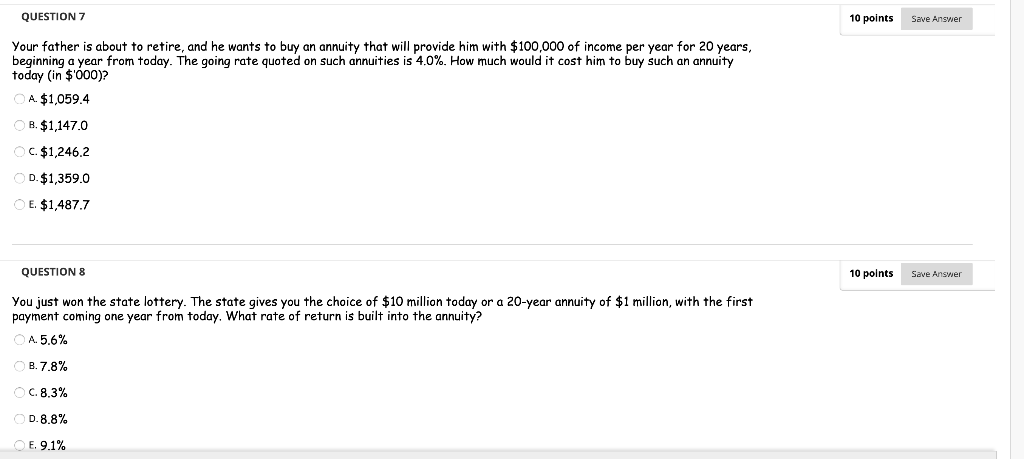

QUESTION 7 10 points Save Answer Your father is about to retire, and he wants to buy an annuity that will provide him with $100,000 of income per year for 20 years, beginning a year from today. The going rate quoted on such annuities is 4.0%. How much would it cost him to buy such an annuity today (in $'000)? OA. $1,059.4 OB. $1,147.0 OC $1,246.2 OD. $1,359.0 OE. $1,487.7 QUESTION 8 10 points Save Answer You just won the state lottery. The state gives you the choice of $10 million today or a 20-year annuity of $1 million, with the first payment coming one year from today. What rate of return is built into the annuity? A.5.6% B. 7.8% OC.8.3% D.8.8% E. 9.1%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts