Question: Question 7 10 pts As an asset manager working for Bits & Coins, you were asked to create a portfolio containing two securities, namely Alpha

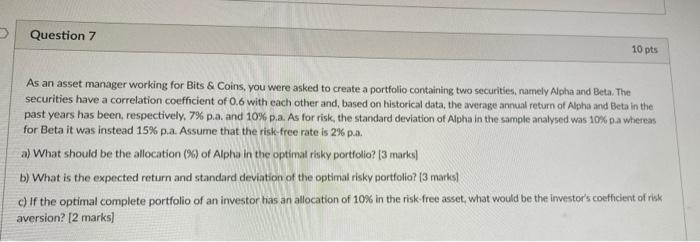

Question 7 10 pts As an asset manager working for Bits & Coins, you were asked to create a portfolio containing two securities, namely Alpha and Beta. The securities have a correlation coefficient of 0.6 with each other and, based on historical data, the average annual return of Alpha and Beta in the past years has been, respectively, 7% p.a. and 10% p.a. As for risk, the standard deviation of Alpha in the sample analysed was 10% pa whereas for Beta it was instead 15% p.a. Assume that the risk-free rate is 2% p.a. a) What should be the allocation (%) of Alpha in the optimal risky portfolio? [3 marks] b) What is the expected return and standard deviation of the optimal risky portfolio? [3 marks] c) If the optimal complete portfolio of an investor has an allocation of 10% in the risk-free asset, what would be the investor's coefficient of risk aversion? [2 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts