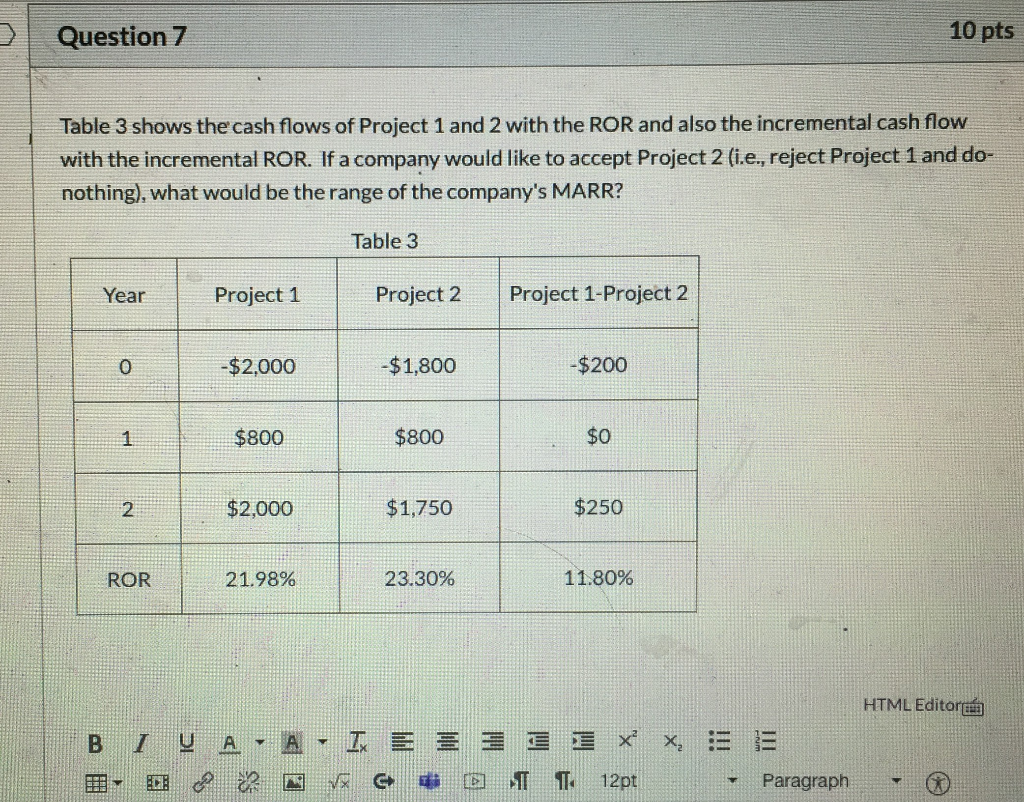

Question: Question 7 10 pts Table 3 shows the cash flows of Project 1 and 2 with the ROR and also the incremental cash flow with

Question 7 10 pts Table 3 shows the cash flows of Project 1 and 2 with the ROR and also the incremental cash flow with the incremental ROR. If a company would like to accept Project 2 (i.e., reject Project 1 and do- nothing), what would be the range of the company's MARR? Table 3 Year Project 1 Project 2 Project 1-Project 2 -$2,000 $1,800 - $200 $800 $800 $0 $2,000 $1,750 $250 ROR 21.98% 23.30% 11.80% HTML Editora B 1y A - A - I, E 3 3 3 3 X X 5. Av G D DT 12pt 5 - = Paragraph - Question 7 10 pts Table 3 shows the cash flows of Project 1 and 2 with the ROR and also the incremental cash flow with the incremental ROR. If a company would like to accept Project 2 (i.e., reject Project 1 and do- nothing), what would be the range of the company's MARR? Table 3 Year Project 1 Project 2 Project 1-Project 2 -$2,000 $1,800 - $200 $800 $800 $0 $2,000 $1,750 $250 ROR 21.98% 23.30% 11.80% HTML Editora B 1y A - A - I, E 3 3 3 3 X X 5. Av G D DT 12pt 5 - = Paragraph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts