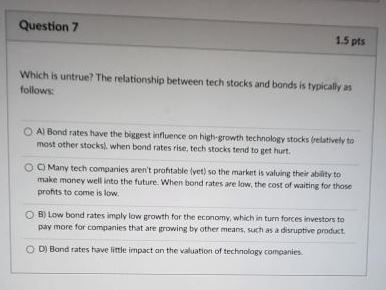

Question: Question 7 1.5 pts Which is untrue? The relationship between tech stocks and bonds is typically as follows: Al Bond rates have the biggest influence

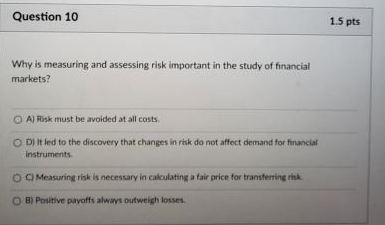

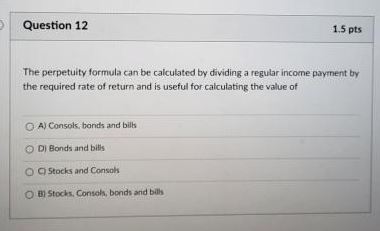

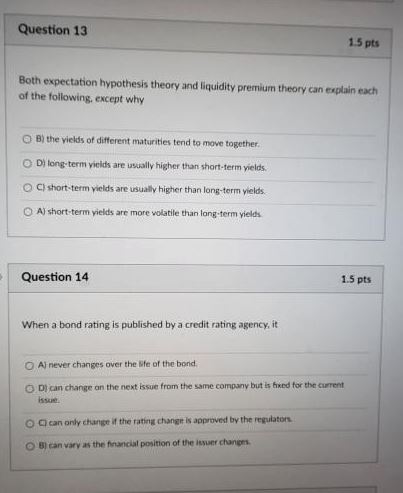

Question 7 1.5 pts Which is untrue? The relationship between tech stocks and bonds is typically as follows: Al Bond rates have the biggest influence on high-growth technology stocks (relatively to most other stocks), when bond rates rise, tech stocks tend to get hurt. OC) Many tech companies aren't profitable (yet) so the market is valuing their ability to make money well into the future. When bond rates are low, the cost of waiting for those prohts to come is low. OB) Low bond rates imply low growth for the economy, which in turn forces investors to pay more for companies that are growing by other means, such as a disruptive product. D) Bond rates have little impact on the valuation of technology companies. Question 10 Why is measuring and assessing risk important in the study of financial markets? OA) Risk must be avoided at all costs. OD) It led to the discovery that changes in risk do not affect demand for financial instruments. OC) Measuring risk is necessary in calculating a fair price for transferring risk B) Positive payoffs always outweigh losses. 1.5 pts Question 12 1.5 pts The perpetuity formula can be calculated by dividing a regular income payment by the required rate of return and is useful for calculating the value of OA) Consols, bonds and bills D) Bonds and bills OO Stocks and Consols OB) Stocks, Consols, bonds and bills Question 13 1.5 pts Both expectation hypothesis theory and liquidity premium theory can explain each of the following, except why B) the yields of different maturities tend to move together. D) long-term yields are usually higher than short-term yields. C) short-term yields are usually higher than long-term yields. OA) short-term yields are more volatile than long-term yields Question 14 1.5 pts When a bond rating is published by a credit rating agency, it A) never changes over the life of the bond. OD) can change on the next issue from the same company but is fixed for the current issue. O can only change if the rating change is approved by the regulators OB) can vary as the financial position of the issuer changes. Question 7 1.5 pts Which is untrue? The relationship between tech stocks and bonds is typically as follows: Al Bond rates have the biggest influence on high-growth technology stocks (relatively to most other stocks), when bond rates rise, tech stocks tend to get hurt. OC) Many tech companies aren't profitable (yet) so the market is valuing their ability to make money well into the future. When bond rates are low, the cost of waiting for those prohts to come is low. OB) Low bond rates imply low growth for the economy, which in turn forces investors to pay more for companies that are growing by other means, such as a disruptive product. D) Bond rates have little impact on the valuation of technology companies. Question 10 Why is measuring and assessing risk important in the study of financial markets? OA) Risk must be avoided at all costs. OD) It led to the discovery that changes in risk do not affect demand for financial instruments. OC) Measuring risk is necessary in calculating a fair price for transferring risk B) Positive payoffs always outweigh losses. 1.5 pts Question 12 1.5 pts The perpetuity formula can be calculated by dividing a regular income payment by the required rate of return and is useful for calculating the value of OA) Consols, bonds and bills D) Bonds and bills OO Stocks and Consols OB) Stocks, Consols, bonds and bills Question 13 1.5 pts Both expectation hypothesis theory and liquidity premium theory can explain each of the following, except why B) the yields of different maturities tend to move together. D) long-term yields are usually higher than short-term yields. C) short-term yields are usually higher than long-term yields. OA) short-term yields are more volatile than long-term yields Question 14 1.5 pts When a bond rating is published by a credit rating agency, it A) never changes over the life of the bond. OD) can change on the next issue from the same company but is fixed for the current issue. O can only change if the rating change is approved by the regulators OB) can vary as the financial position of the issuer changes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts