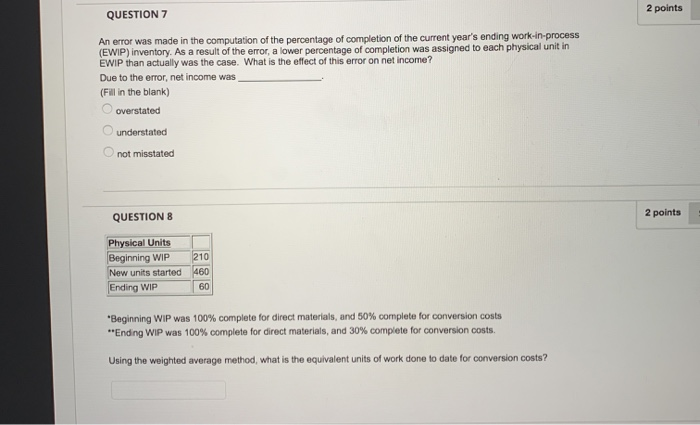

Question: QUESTION 7 2 points An error was made in the computation of the percentage of completion of the current year's ending work-in-process (EWIP) inventory. As

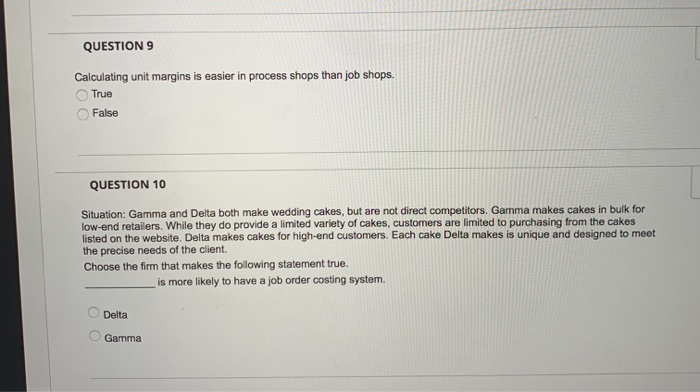

QUESTION 7 2 points An error was made in the computation of the percentage of completion of the current year's ending work-in-process (EWIP) inventory. As a result of the error a lower percentage of completion was assigned to each physical unit in EWIP than actually was the case. What is the effect of this error on net income? Due to the error, net income was (Fill in the blank) overstated understated not misstated QUESTION 8 2 points Physical Units Beginning WIP New units started Ending WIP 210 460 60 "Beginning WIP was 100% complete for direct materials, and 50% complete for conversion costs *Ending WIP was 100% complete for direct materials, and 30% complete for conversion costs Using the weighted average method, what is the equivalent units of work done to date for conversion costs? QUESTION 9 Calculating unit margins is easier in process shops than job shops. True False QUESTION 10 es but are not directors are limited to pure and designed Situation: Gamma and Delta both make wedding cakes, but are not direct competitors, Gamma makes cakes in bulk for low-end retailers. While they do provide a limited variety of cakes, customers are limited to purchasing from the cakes listed on the website. Delta makes cakes for high-end customers. Each cake Delta makes is unique and designed to meet the precise needs of the client. Choose the firm that makes the following statement true. is more likely to have a job order costing system. Delta Gamma

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts