Question: Question 7 (2 points) Listen Stock A has a beta of 3, the risk-free rate is 4% and the return on the market is 9%.

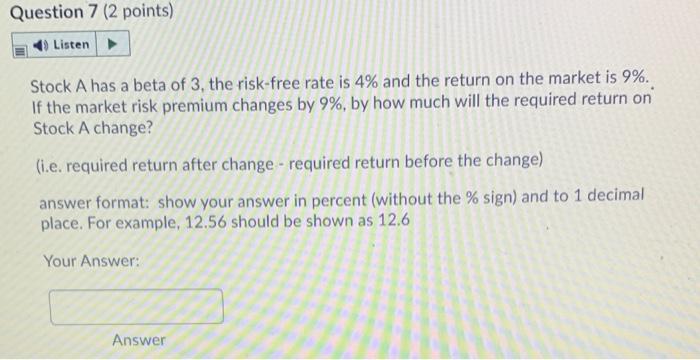

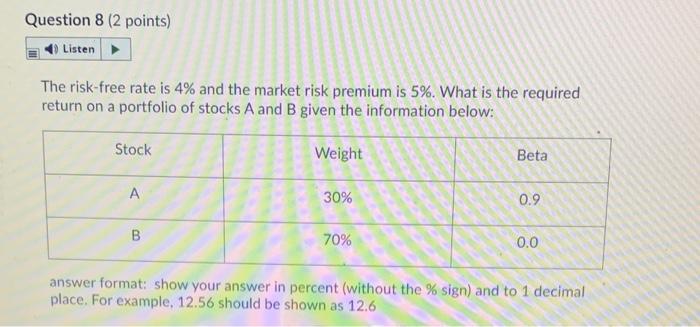

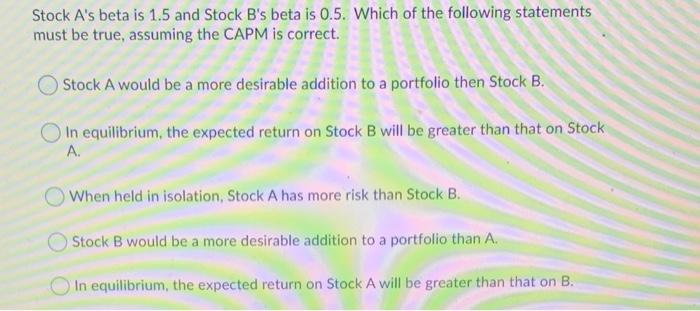

Question 7 (2 points) Listen Stock A has a beta of 3, the risk-free rate is 4% and the return on the market is 9%. If the market risk premium changes by 9%, by how much will the required return on Stock A change? (i.e. required return after change - required return before the change) answer format: show your answer in percent (without the % sign) and to 1 decimal place. For example, 12.56 should be shown as 12.6 Your Answer: Answer Question 8 (2 points) Listen The risk-free rate is 4% and the market risk premium is 5%. What is the required return on a portfolio of stocks A and B given the information below: Stock Weight Beta A 30% 0.9 B 70% 0.0 answer format: show your answer in percent (without the % sign) and to 1 decimal place. For example, 12.56 should be shown as 12.6 Stock A's beta is 1.5 and Stock B's beta is 0.5. Which of the following statements must be true, assuming the CAPM is correct. Stock A would be a more desirable addition to a portfolio then Stock B. In equilibrium, the expected return on Stock B will be greater than that on Stock A When held in isolation, Stock A has more risk than Stock B. Stock B would be a more desirable addition to a portfolio than A. In equilibrium, the expected return on Stock A will be greater than that on B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts