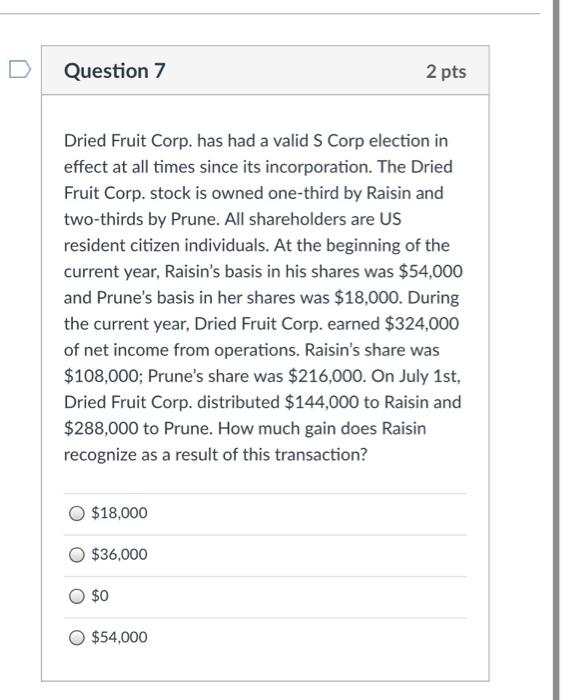

Question: Question 7 2 pts Dried Fruit Corp. has had a valid S Corp election in effect at all times since its incorporation. The Dried Fruit

Question 7 2 pts Dried Fruit Corp. has had a valid S Corp election in effect at all times since its incorporation. The Dried Fruit Corp. stock is owned one-third by Raisin and two-thirds by Prune. All shareholders are US resident citizen individuals. At the beginning of the current year, Raisin's basis in his shares was $54,000 and Prune's basis in her shares was $18,000. During the current year, Dried Fruit Corp. earned $324,000 of net income from operations. Raisin's share was $108,000; Prune's share was $216,000. On July 1st, Dried Fruit Corp. distributed $144,000 to Raisin and $288,000 to Prune. How much gain does Raisin recognize as a result of this transaction? $18,000 $36,000 $0 $54,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts