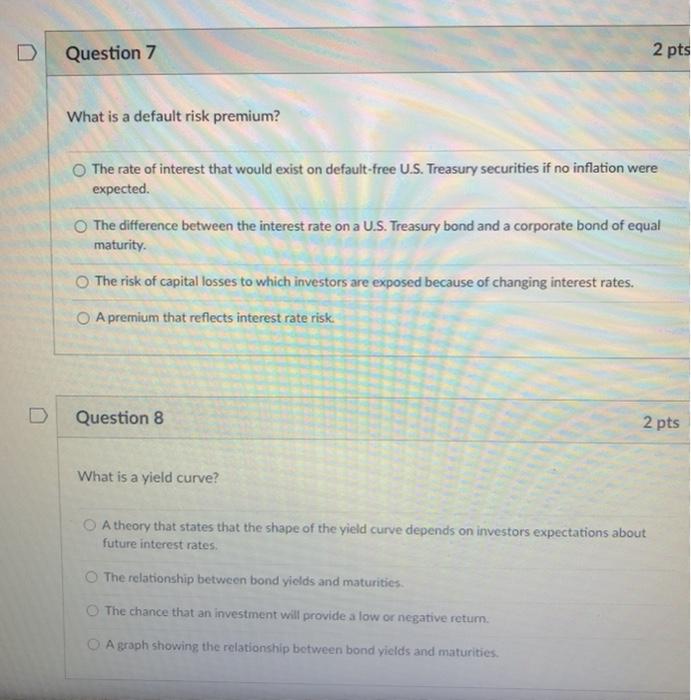

Question: Question 7 2 pts What is a default risk premium? The rate of interest that would exist on default-free U.S. Treasury securities if no inflation

Question 7 2 pts What is a default risk premium? The rate of interest that would exist on default-free U.S. Treasury securities if no inflation were expected The difference between the interest rate on a U.S. Treasury bond and a corporate bond of equal maturity. The risk of capital losses to which investors are exposed because of changing interest rates. O A premium that reflects interest rate risk. Question 8 2 pts What is a yield curve? A theory that states that the shape of the yield curve depends on investors expectations about future interest rates. The relationship between bond yields and maturities. The chance that an investment will provide a low or negative retum. A graph showing the relationship between bond yields and maturities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts