Question: Question #7 (20 marks) Q7-Part I (8 marks) One hundred futures contracts are applied to hedge the price risk of silver. One futures contract is

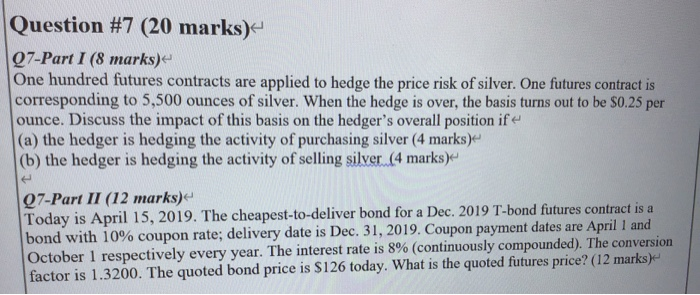

Question #7 (20 marks) Q7-Part I (8 marks) One hundred futures contracts are applied to hedge the price risk of silver. One futures contract is corresponding to 5,500 ounces of silver. When the hedge is over, the basis turns out to be $0.25 per ounce. Discuss the impact of this basis on the hedger's overall position if (a) the hedger is hedging the activity of purchasing silver (4 marks) (b) the hedger is hedging the activity of selling silver (4 marks) 97-Part II (12 marks) Today is April 15, 2019. The cheapest-to-deliver bond for a Dec. 2019 T-bond futures contract is a bond with 10% coupon rate; delivery date is Dec. 31, 2019. Coupon payment dates are April 1 and October 1 respectively every year. The interest rate is 8% (continuously compounded). The conversion factor is 1.3200. The quoted bond price is $126 today. What is the quoted futures price? (12 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts