Question: Question 7 --/24 View Policies Current Attempt in Progress On January 1, 2016, Sheridan Corporation acquired equipment costing $72,320. It was estimated at that time

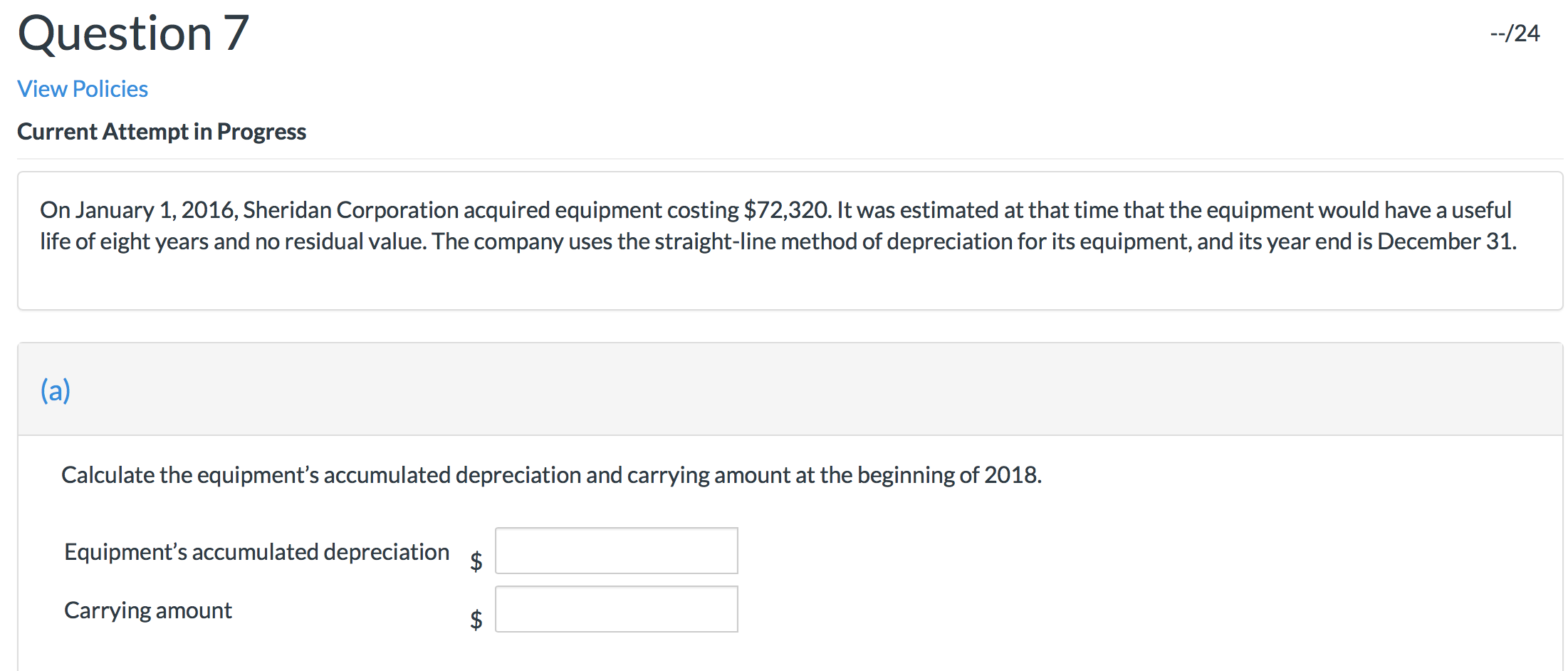

Question 7 --/24 View Policies Current Attempt in Progress On January 1, 2016, Sheridan Corporation acquired equipment costing $72,320. It was estimated at that time that the equipment would have a useful life of eight years and no residual value. The company uses the straight-line method of depreciation for its equipment, and its year end is December 31. (a) Calculate the equipment's accumulated depreciation and carrying amount at the beginning of 2018. Equipment's accumulated depreciation $ Carrying amount tA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts