Question 7 (25 points, Ch8Q5):

You have developed the technology to use gold to produce high-capacity fiber optic switches.

The technology has cost $ 5 million to develop. You need $50 million of initial capital

investment to start production. Sales of the Switch sales will be $20 million per year for

the next 5 years and then drop to zero. The main cost of production is gold. Each year,

you need 20,000 ounces of gold. Gold is currently selling for $250 per ounce. Your supplier

thinks that the gold price will be appreciated at 5% per year for the next 5 years. The cost of

capital is 10% for the fiber-optics business. The tax rate is 35%. The capital investment can

be depreciated linearly over the next 5 years.

a. Calculate the after-tax cash flows of the project.

b. Should you take the project?

Question:

a) Ms. Shokha wants to make an investment today that will have a future value of $500 one year from today. If she has a choice of a 5% discount rate or a 6% discount rate, which investment should she choose?

b) Calculate the average annual return for a $3,000 investment with an ending price of $5,500 four years later, with no intermediate cash flows.

c) Consider an investment with the following cash flows:

Year

Cash flows

2003

$20,000

2004

$40,000

2005

$25,000

2006

$35.000

What are the most the investor would invest so that the return on the investment is at least 10%?

d) Suppose the expected risk-free asset is 6% and the return on the market is 10%. Further, suppose you have a portfolio comprised of the following securities with equal investments in each:

(i) What is the expected return for each security in the portfolio?

(ii) What is the expected return on the portfolio?

?

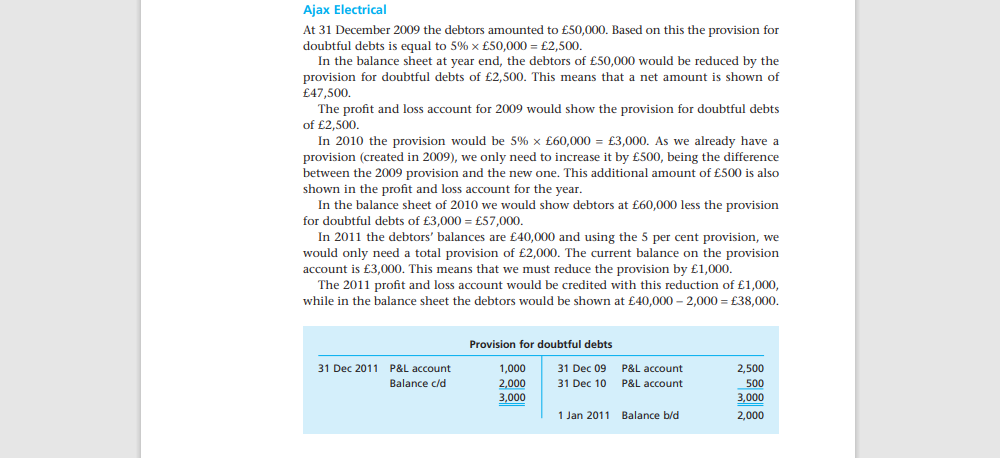

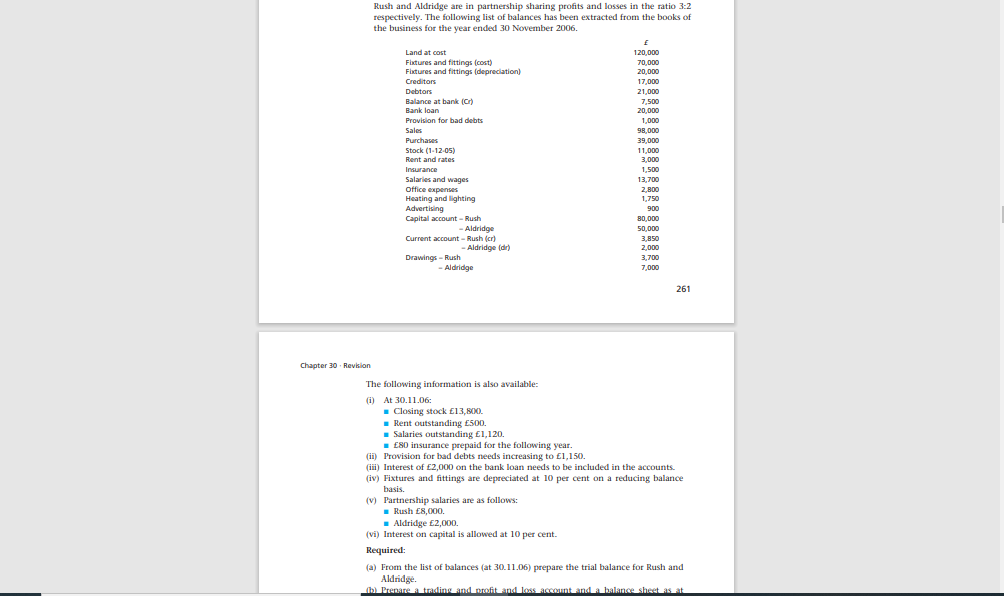

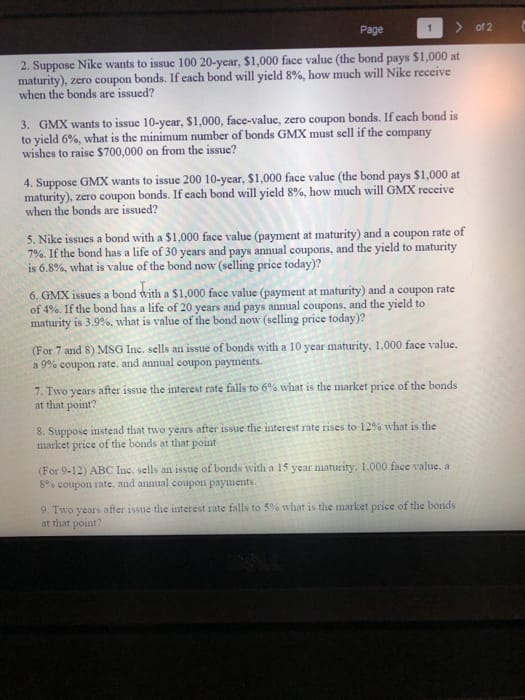

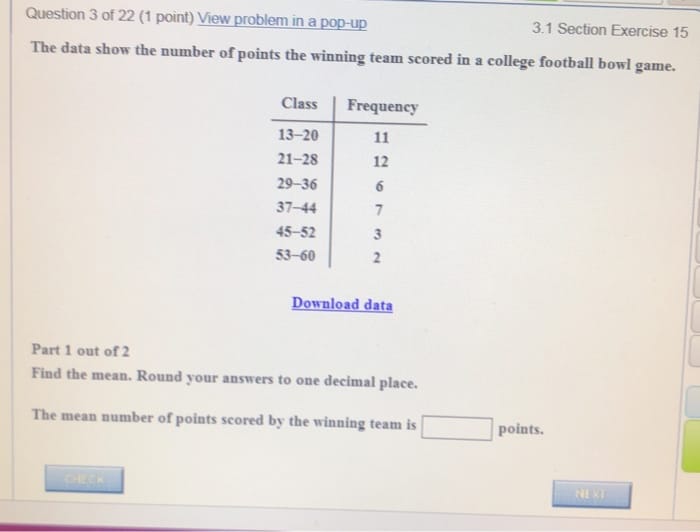

Ajax Electrical At 31 December 2009 the debtors amounted to 50,030, Based on this die provision for doubtful debts is equal to 5% 5: 50,000 = 2,500, [n the balance sheet at year end, the debtors of 50,000 would be reduoed by the provision for doubtful debts of 2,500. This means that a net amount is shown of 4?,500. The prot and loss account for 2009 would show the provision for doubtful debts of 2,500. [n 2010 the provision would be 5% x 50,030 = 3,000, As we already have a provision (created in 2009], we onl},r need to increase it by 500, being the difference between the 2.009 provision and the new one. This additional amount of 503 is also shown in the prot and loss account for the year. In the balanoe sheet of 2010 we would show debtors at 60,000 less the provision for doubtful debts of 3,000 = 5?,000. [[1 2011 the debtors' balanca are 40,000 and using the 5 per cent provisicm, we would only need a total provision of 2,000. The current balance on the provision account is 3,030. This means that we must reduce the provision by 1,000. The 2011 prot and loss account would be credited with this reduction of 1,003, while in the balance sheet the debtors would be shown at 40,000 2,000 $33,000, Ploulslonfnldollltlldlhts 31 Dacia" PsL amwm: 1,000 31 02:09 ML account 2,511: Balance dd gone 31 Dec 10 P&L amount so: 3&0 Eng 1 Jan 2911 Balance Nd 2.01:0 Rush and Aldridge are in partnership sharing profits and losses in the ratio 3:2 respectively. The following list of balances has been extracted from the books of the business for the year ended 30 November 2006. Land at cost 120,000 Fixtures and fittings [cost) 70,000 Fixtures and fittings (depredation) 20.000 Creditors 17/000 Debtors 21,000 Balance at bank (Cr) 7,500 Bank loan 20,000 Provision for bad debts 1,000 Sales 98,D00 Purchases 39,000 Stock (1-12-05) 11.DO Rent and rates 3,000 Insurance 1,500 Salaries and wages 13,70 Office expenses 2.8DO Heating and lighting 1,750 Advertising 900 Capital account - Rush 80,DO0 - Aldridge 50,000 Current account - Rush (cr] 3,850 - Aldridge [dr) 2,000 Drawings - Rush 3,700 - Aldridge 261 Chapter 30 . Revkion The following information is also available: (i) At 30.11.06: Closing stock $13,800. . Rent outstanding E500. Salaries outstanding El,120. E80 insurance prepaid for the following year. (if) Provision for bad debts needs increasing to El, 150. (iii) Interest of E2,000 on the bank loan needs to be included in the accounts. (iv) Fixtures and fittings are depreciated at 10 per cent on a reducing balance basis. (v) Partnership salaries are as follows: Rush E8,000. Aldridge $2,000. (vi) Interest on capital is allowed at 10 per cent. Required (a) From the list of balances (at 30.11.06) prepare the trial balance for Rush and Aldridge. in Prepare a trading and profit a Frid loss account and a balance sheet aPage 1 > of 2 2. Suppose Nike wants to issue 100 20-year, $1,000 face value (the bond pays $1,000 at maturity), zero coupon bonds. If each bond will yield 8%, how much will Nike receive when the bonds are issued? 3. GMX wants to issue 10-year, $1,000, face-value, zero coupon bonds. If each band is to yield 6%, what is the minimum number of bonds GMX must sell if the company wishes to raise $700,000 on from the issue? 4. Suppose GMX wants to issue 200 10-year, $1,000 face value (the bond pays $1,000 at maturity), zero coupon bonds. If each bond will yield 8%, how much will GMX receive when the bonds are issued? 5. Nike issues a bond with a $1,000 face value (payment at maturity) and a coupon rate of 7%. If the bond has a life of 30 years and pays annual coupons, and the yield to maturity is 6.8%, what is value of the bond now (selling price today)? 6. GMX issues a bond with a $1,000 face value (payment at maturity) and a coupon rate of 4%. If the bond has a life of 20 years and pays annual coupons, and the yield to maturity is 3.9%%, what is value of the bond now (selling price today)? (For 7 and 8) MSG Inc. sells an issue of bonds with a 10 year maturity. 1.000 face value. 1 9% coupon rate, and annual coupon payments. 7. Two years after issue the interest rate falls to 6% what is the market price of the bonds at that point? 8. Suppose instead that two years after issue the interest rate rises to 12% what is the market price of the bonds at that point (For 9-12) ABC Inc. sells an issue of bonds with a 15 year maturity. 1.000 face value, a 8% coupon rate, and annual coupon payments 9. Two years after isone the interest rate falls to 59% what is the market price of the bonds at that point?Question 3 of 22 (1 point) View problem in a pop-up 3.1 Section Exercise 15 The data show the number of points the winning team scored in a college football bowl game. Class Frequency 13-20 11 21-28 12 29-36 6 37-44 45-52 N WI 53-60 Download data Part 1 out of 2 Find the mean. Round your answers to one decimal place. The mean number of points scored by the winning team is points