Question: Question 7 (25 points) Stark Enterprises is considering the purchase of a time travel machine costing $30 billion (after tax) that will result in initial

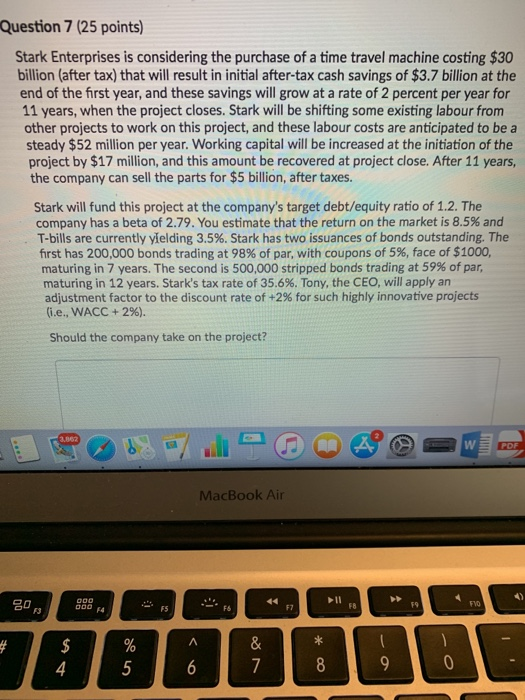

Question 7 (25 points) Stark Enterprises is considering the purchase of a time travel machine costing $30 billion (after tax) that will result in initial after-tax cash savings of $3.7 billion at the end of the first year, and these savings will grow at a rate of 2 percent per year for 11 years, when the project closes. Stark will be shifting some existing labour from other projects to work on this project, and these labour costs are anticipated to be a steady $52 million per year. Working capital will be increased at the initiation of the project by $17 million, and this amount be recovered at project close. After 11 years, the company can sell the parts for $5 billion, after taxes. Stark will fund this project at the company's target debt/equity ratio of 1.2. The company has a beta of 2.79. You estimate that the return on the market is 8.5% and T-bills are currently yielding 3.5%. Stark has two issuances of bonds outstanding. The first has 200,000 bonds trading at 98% of par, with coupons of 5%, face of $1000, maturing in 7 years. The second is 500,000 stripped bonds trading at 59% of par, maturing in 12 years. Stark's tax rate of 35.6%. Tony, the CEO, will apply an adjustment factor to the discount rate of +2% for such highly innovative projects (i.e., WACC + 2%). Should the company take on the project? MacBook Air Question 7 (25 points) Stark Enterprises is considering the purchase of a time travel machine costing $30 billion (after tax) that will result in initial after-tax cash savings of $3.7 billion at the end of the first year, and these savings will grow at a rate of 2 percent per year for 11 years, when the project closes. Stark will be shifting some existing labour from other projects to work on this project, and these labour costs are anticipated to be a steady $52 million per year. Working capital will be increased at the initiation of the project by $17 million, and this amount be recovered at project close. After 11 years, the company can sell the parts for $5 billion, after taxes. Stark will fund this project at the company's target debt/equity ratio of 1.2. The company has a beta of 2.79. You estimate that the return on the market is 8.5% and T-bills are currently yielding 3.5%. Stark has two issuances of bonds outstanding. The first has 200,000 bonds trading at 98% of par, with coupons of 5%, face of $1000, maturing in 7 years. The second is 500,000 stripped bonds trading at 59% of par, maturing in 12 years. Stark's tax rate of 35.6%. Tony, the CEO, will apply an adjustment factor to the discount rate of +2% for such highly innovative projects (i.e., WACC + 2%). Should the company take on the project? MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts