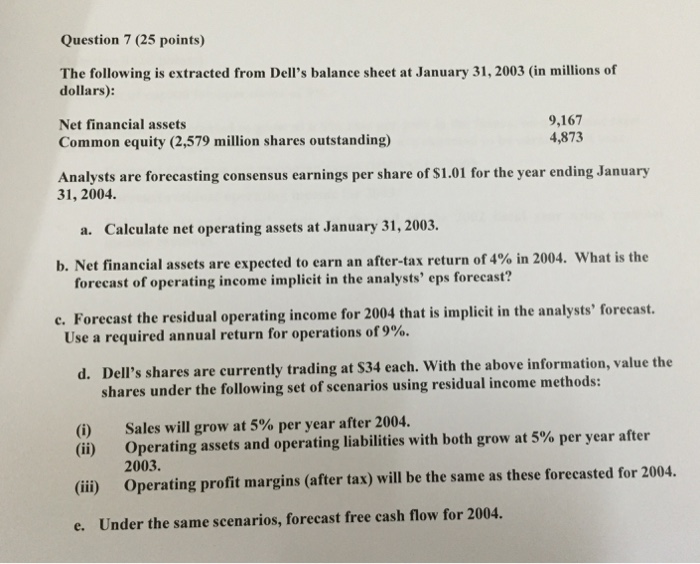

Question: Question 7 (25 points) The following is extracted from Dell's balance sheet at January 31,2003 (in millions of dollars): Net financial assets Common equity (2,579

Question 7 (25 points) The following is extracted from Dell's balance sheet at January 31,2003 (in millions of dollars): Net financial assets Common equity (2,579 million shares outstanding) 9,167 4,873 Analysts are forecasting consensus earnings per share of $1.01 for the year ending January 1, 2004. a. Calculate net operating assets at January 31,2003. b. Net financial assets are expected to earn an after-tax return of 4% in 2004. what is the forecast of operating income implicit in the analysts' eps forecast? e. Forecast the residual operating income for 2004 that is implicit in the analysts' forecast. Use a required annual return for operations of 9%. d. Dell's shares are currently trading at $34 each. With the above information, value the shares under the following set of scenarios using residual income methods: (i) Sales will grow at 5% per year after 2004. (i) Operating assets and operating liabilities with both grow at 5% per year after (iil) Operating profit margins (after tax) will be the same as these forecasted for 2004. e. Under the same scenarios, forecast free cash flow for 2004. 2003

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts