Question: Question 7 25 pts (CHAPTER 18) A company would like to figure out if a 10-year project is worth it. The company is in the

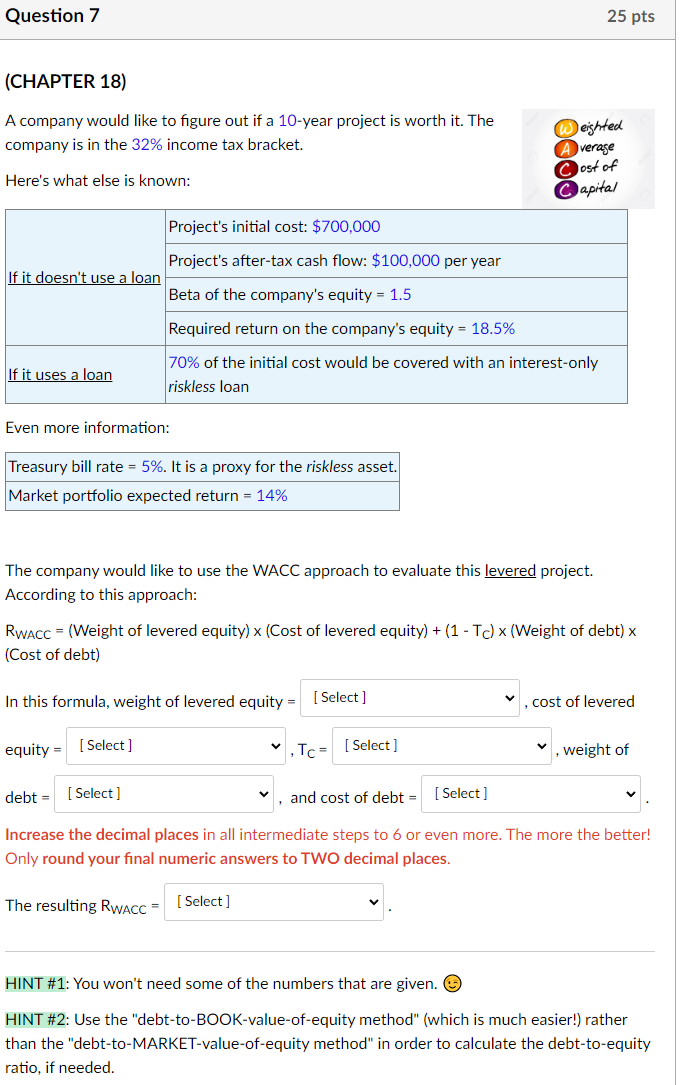

Question 7 25 pts (CHAPTER 18) A company would like to figure out if a 10-year project is worth it. The company is in the 32% income tax bracket. Deighted Average Cost of Capital Here's what else is known: Project's initial cost: $700,000 Project's after-tax cash flow: $100,000 per year If it doesn't use a loan Beta of the company's equity = 1.5 Required return on the company's equity = 18.5% If it uses a loan 70% of the initial cost would be covered with an interest-only riskless loan Even more information: Treasury bill rate = 5%. It is a proxy for the riskless asset. Market portfolio expected return = 14% The company would like to use the WACC approach to evaluate this levered project. According to this approach: RWACC = (Weight of levered equity) (Cost of levered equity) + (1 - Tx (Weight of debt) x (Cost of debt) In this formula, weight of levered equity = [Select] cost of levered equity - [ Select] Tc= [ Select] weight of debt = [Select] and cost of debt = [ Select] Increase the decimal places in all intermediate steps to 6 or even more. The more the better! Only round your final numeric answers to TWO decimal places. The resulting RWACC = [Select ] HINT #1: You won't need some of the numbers that are given. HINT #2: Use the "debt-to-BOOK-value-of-equity method" (which is much easier!) rather than the "debt-to-MARKET-value-of-equity method" in order to calculate the debt-to-equity ratio, if needed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts