Question: Question 7 (2pt) Please indicate whether the following statements are true or false. In case of a false statement, briefly specify why the statement is

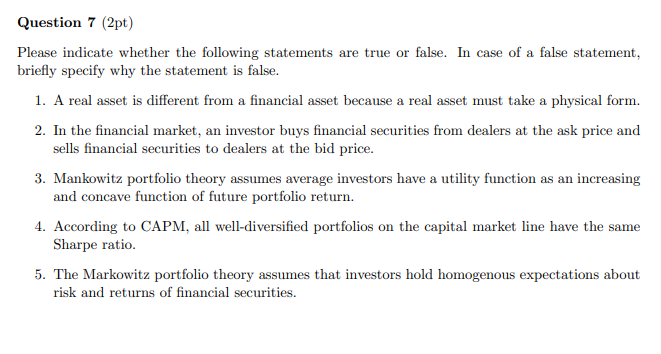

Question 7 (2pt) Please indicate whether the following statements are true or false. In case of a false statement, briefly specify why the statement is false. 1. A real asset is different from a financial asset because a real asset must take a physical form. 2. In the financial market, an investor buys financial securities from dealers at the ask price and sells financial securities to dealers at the bid price. 3. Mankowitz portfolio theory assumes average investors have a utility function as an increasing and concave function of future portfolio return. 4. According to CAPM, all well-diversified portfolios on the capital market line have the same Sharpe ratio. 5. The Markowitz portfolio theory assumes that investors hold homogenous expectations about risk and returns of financial securities. Question 7 (2pt) Please indicate whether the following statements are true or false. In case of a false statement, briefly specify why the statement is false. 1. A real asset is different from a financial asset because a real asset must take a physical form. 2. In the financial market, an investor buys financial securities from dealers at the ask price and sells financial securities to dealers at the bid price. 3. Mankowitz portfolio theory assumes average investors have a utility function as an increasing and concave function of future portfolio return. 4. According to CAPM, all well-diversified portfolios on the capital market line have the same Sharpe ratio. 5. The Markowitz portfolio theory assumes that investors hold homogenous expectations about risk and returns of financial securities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts