Question: Question 7 (3 points) A potential advantage for a corporation to issuing convertible bonds is both of the first two answers above. Oif converted they

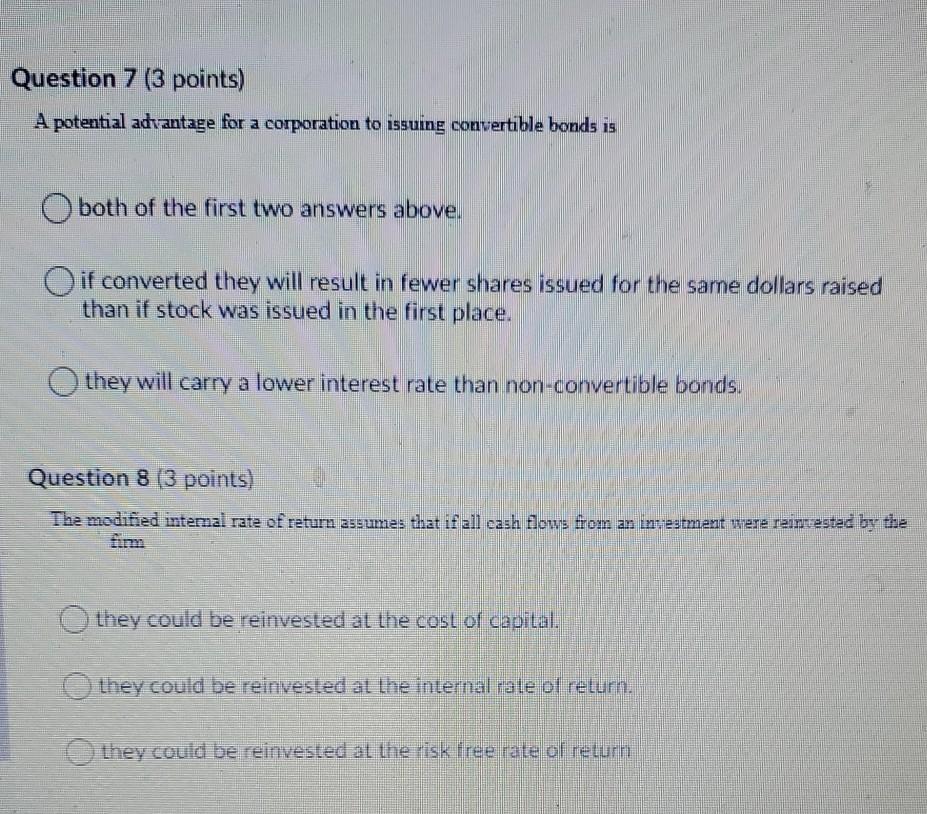

Question 7 (3 points) A potential advantage for a corporation to issuing convertible bonds is both of the first two answers above. Oif converted they will result in fewer shares issued for the same dollars raised than if stock was issued in the first place. Othey will carry a lower interest rate than non-convertible bonds. Question 8 (3 points) The modified intemal rate of return assumes that if all cash flows from an in--23tment were reinvested by the they could be reinvested at the cost of capital. they could be reinvested at the internal rate of return. they could be reinvested at the risk free rate of return

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock