Question: Question 7 (3 points) Listen Using the One Period Valuation Model You are thinking about buying CNQ (Canadian Natural Resources) stock. Their stock is currently

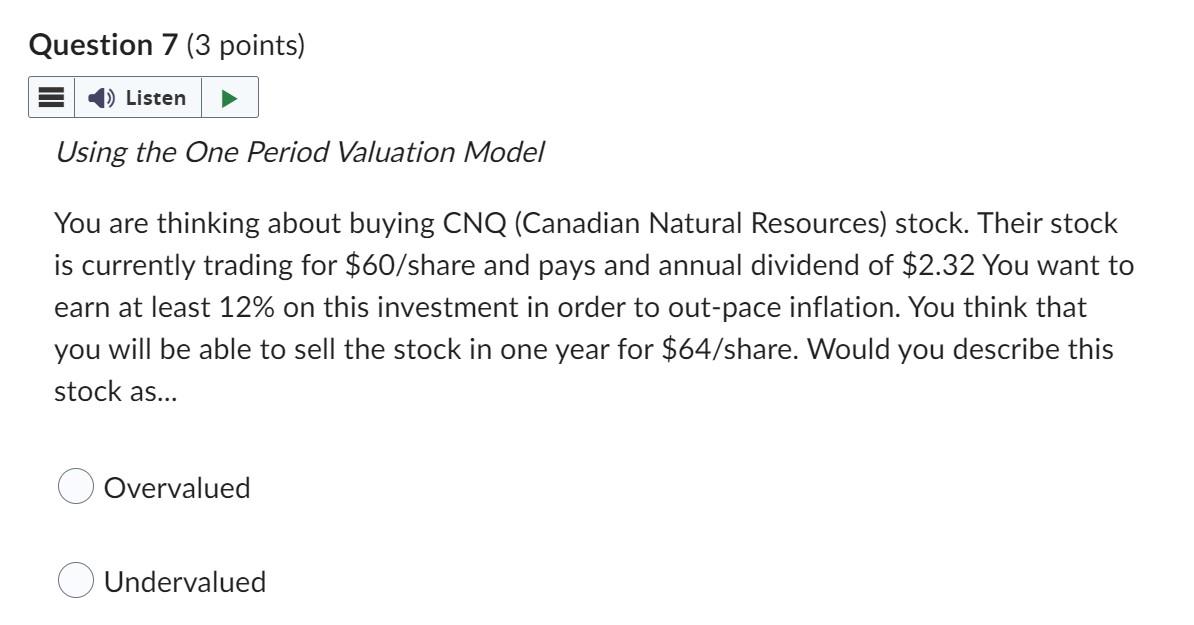

Question 7 (3 points) Listen Using the One Period Valuation Model You are thinking about buying CNQ (Canadian Natural Resources) stock. Their stock is currently trading for $60/share and pays and annual dividend of $2.32 You want to earn at least 12% on this investment in order to out-pace inflation. You think that you will be able to sell the stock in one year for $64/share. Would you describe this stock as... Overvalued Undervalued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts