Question: Question 7 3.85 pts Maureen Smith is a single individual. She claims a standard deduction of $12,000. Her salary for the year was $223,650. Assume

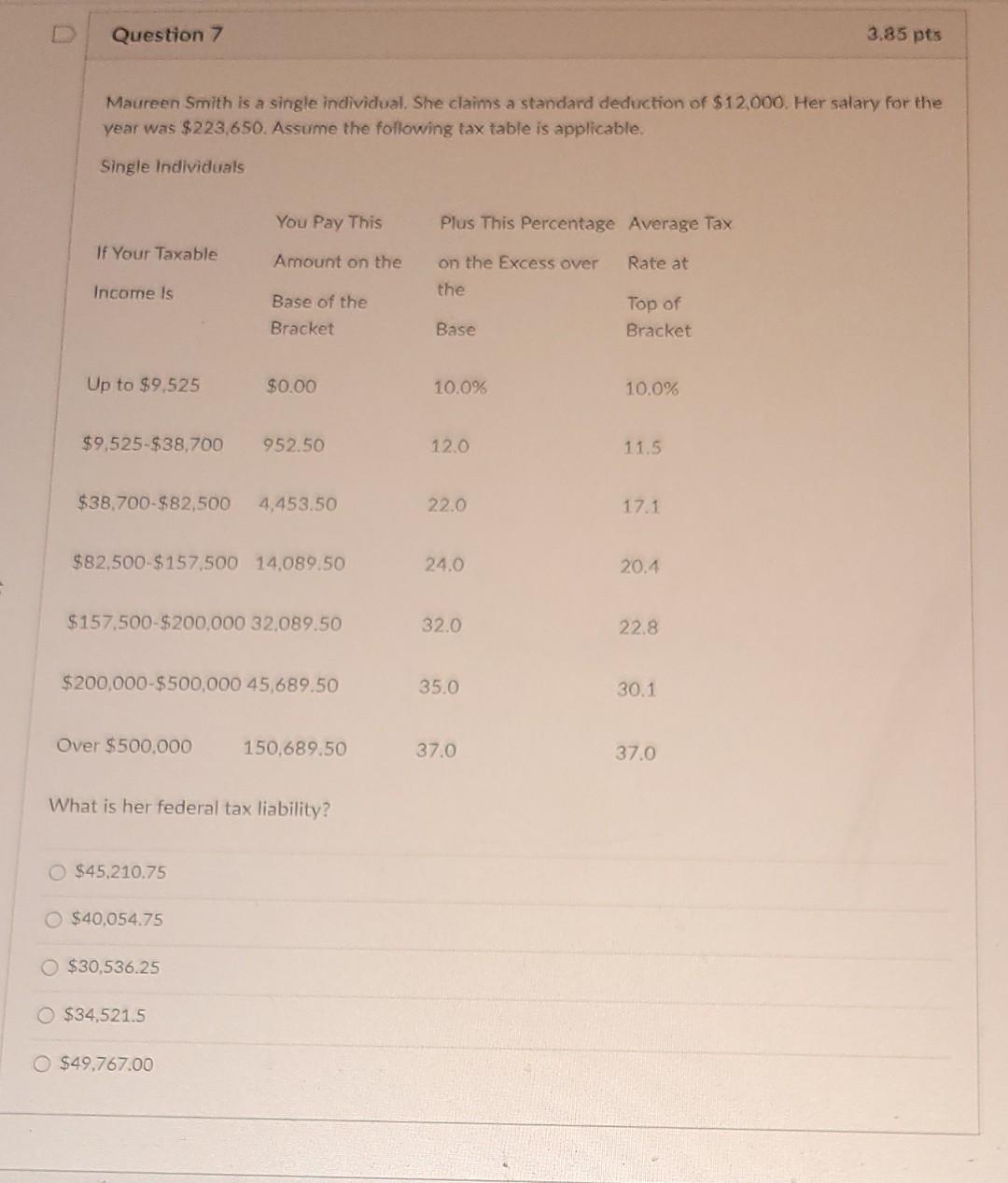

Question 7 3.85 pts Maureen Smith is a single individual. She claims a standard deduction of $12,000. Her salary for the year was $223,650. Assume the following tax table is applicable. Single Individuals You Pay This Plus This Percentage Average Tax If Your Taxable Amount on the Rate at on the Excess over the Income is Base of the Bracket Top of Bracket Base Up to $9.525 $0.00 10.0% 10.0% $9,525-$38,700 952.50 12.0 11.5 $38.700-$82,500 4,453.50 22.0 17.1 $82,500-$157.500 14.089.50 24.0 20.4 $157,500-$200.000 32.089.50 32.0 22.8 $200,000-$500,000 45,689.50 35.0 30.1 Over $500.000 150,689.50 37.0 37,0 What is her federal tax liability? O $45.210.75 $40.054.75 O $30,536.25 O $34,521.5 O $49.767.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts