Question: QUESTION 7 (5 Marks) Labor Rate Variance . . Bruce incurred actual direct labor costs of $14,040 in March. Standard hourly Labor rate $14 The

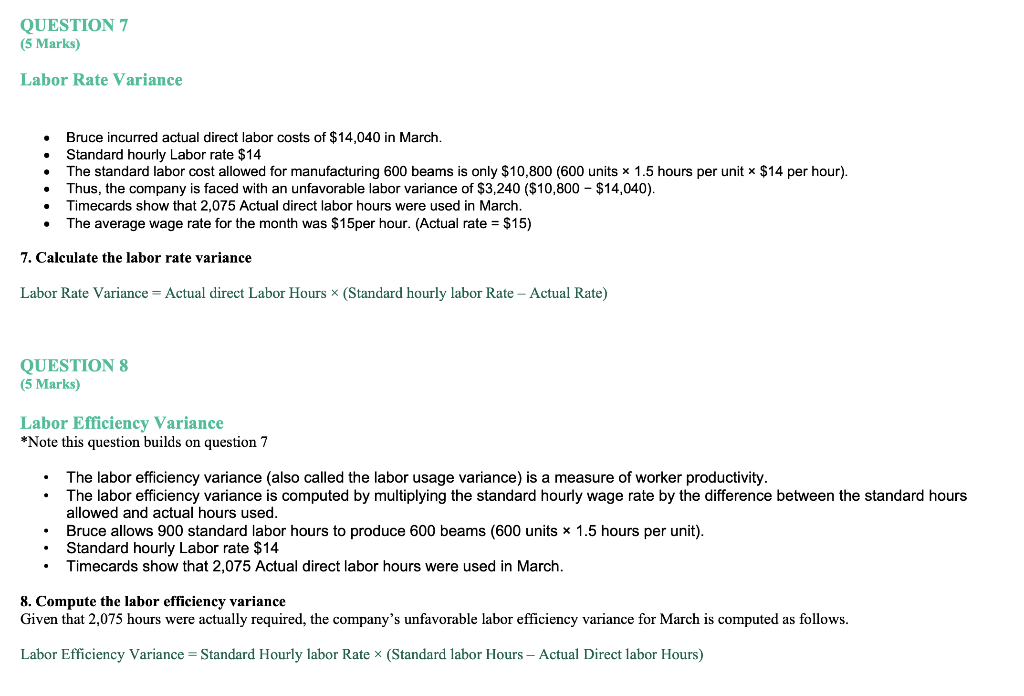

QUESTION 7 (5 Marks) Labor Rate Variance . . Bruce incurred actual direct labor costs of $14,040 in March. Standard hourly Labor rate $14 The standard labor cost allowed for manufacturing 600 beams is only $10,800 (600 units X 1.5 hours per unit * $14 per hour). Thus, the company is faced with an unfavorable labor variance of $3,240 ($10,800 - $14,040). Timecards show that 2,075 Actual direct labor hours were used in March. The average wage rate for the month was $15per hour. (Actual rate = $15) . 7. Calculate the labor rate variance Labor Rate Variance = Actual direct Labor Hours (Standard hourly labor Rate - Actual Rate) QUESTION 8 (5 Marks) Labor Efficiency Variance *Note this question builds on question 7 The labor efficiency variance (also called the labor usage variance) is a measure of worker productivity. The labor efficiency variance is computed by multiplying the standard hourly wage rate by the difference between the standard hours allowed and actual hours used. Bruce allows 900 standard labor hours to produce 600 beams (600 units x 1.5 hours per unit). Standard hourly Labor rate $14 Timecards show that 2,075 Actual direct labor hours were used in March. 8. Compute the labor efficiency variance Given that 2,075 hours were actually required, the company's unfavorable labor efficiency variance for March is computed as follows. Labor Efficiency Variance = Standard Hourly labor Rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts