Question: Question 7 ( 5 points ) Listen Your client, Lucy Jones, is a full time student at a local university. She is 2 2 years

Question points

Listen

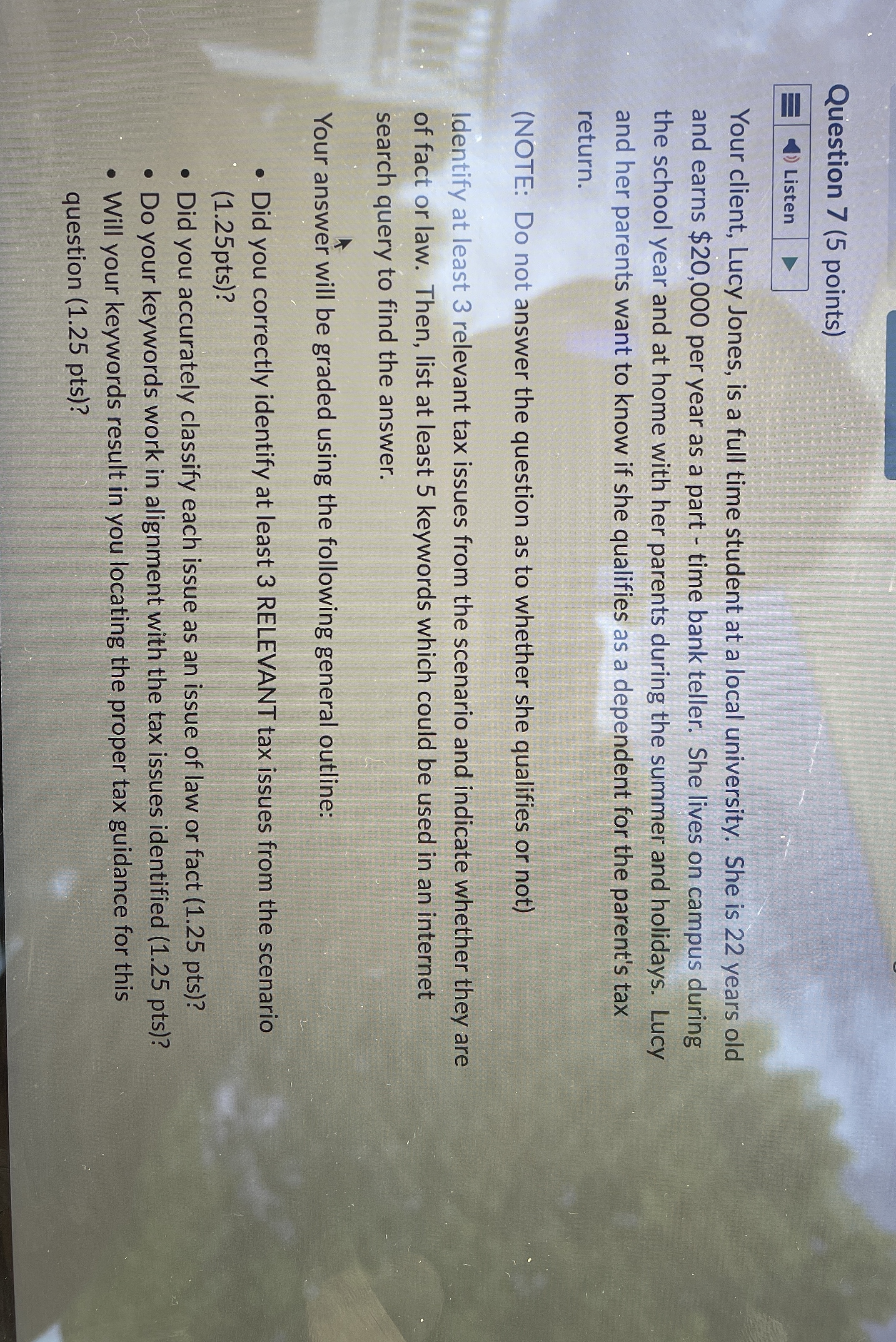

Your client, Lucy Jones, is a full time student at a local university. She is years old and earns $ per year as a part time bank teller. She lives on campus during the school year and at home with her parents during the summer and holidays. Lucy and her parents want to know if she qualifies as a dependent for the parent's tax return.

NOTE: Do not answer the question as to whether she qualifies or not

Identify at least relevant tax issues from the scenario and indicate whether they are of fact or law. Then, list at least keywords which could be used in an internet search query to find the answer.

Your answer will be graded using the following general outline:

Did you correctly identify at least RELEVANT tax issues from the scenario pts

Did you accurately classify each issue as an issue of law or fact pts

Do your keywords work in alignment with the tax issues identified

Will your keywords result in you locating the proper tax guidance for this question pts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock