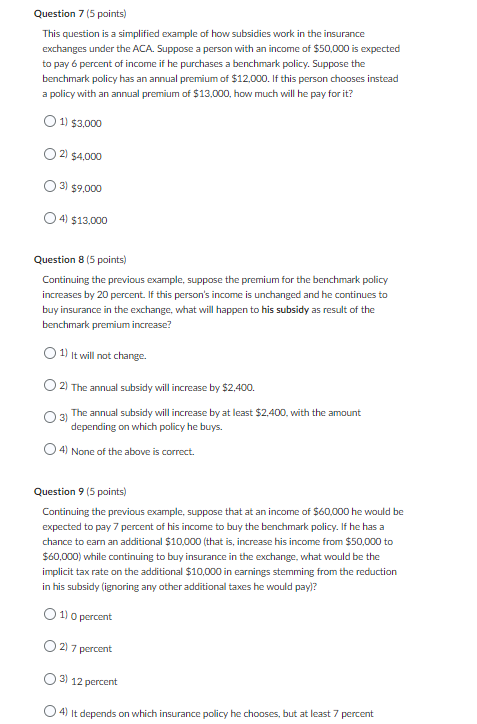

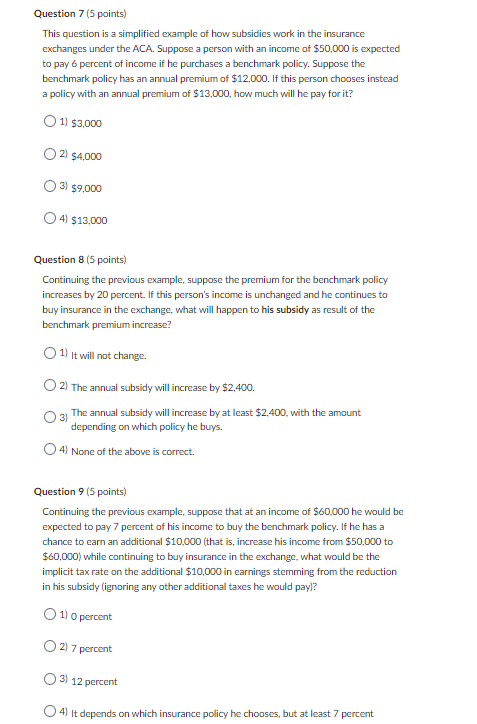

Question: Question 7 (5 points) This question is a simplified example of how subsidies work in the insurance exchanges under the ACA. Suppose a person with

Question 7 (5 points) This question is a simplified example of how subsidies work in the insurance exchanges under the ACA. Suppose a person with an income of $50,000 is expected to pay 6 percent of income if he purchases a benchmark policy. Suppose the benchmark policy has an annual premium of $12,000. If this person chooses instead a policy with an annual premium of $13,000, how much will he pay for it? O 1) $3,000 2) $4,000 ( 3) $9,000 4) $13,000 Question 8 (5 points) Continuing the previous example, suppose the premium for the benchmark policy increases by 20 percent. If this person's income is unchanged and he continues to buy insurance in the exchange, what will happen to his subsidy as result of the benchmark premium increase? O 1) It will not change. (O 2) The annual subsidy will increase by $2,400. Og) The annual subsidy will increase by at least $2,400, with the amount depending on which policy he buys. ( 4) None of the above is correct. Question 9 (5 points) Continuing the previous example, suppose that at an income of $60.000 he would be expected to pay 7 percent of his income to buy the benchmark policy. If he has a chance to earn an additional $10.000 (that is, increase his income from $50,000 to $60,000) while continuing to buy insurance in the exchange, what would be the implicit tax rate on the additional $10,000 in earnings stemming from the reduction in his subsidy (ignoring any other additional taxes he would pay)? O 1) 0 percent ( 2) 7 percent 3) 12 percent (O 4) It depends on which insurance policy he chooses, but at least 7 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts