Question: Question 7 7. Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset

Question 7

7. Balloons By Sunset (BBS) is considering the purchase of two new hot air balloons so that it can expand its desert sunset tours. Various information about the proposed investment follows:

| Initial investment (for two hot air balloons) | $ | 394,000 | |||||

| Useful life | 9 | years | |||||

| Salvage value | $ | 43,000 | |||||

| Annual net income generated | 31,914 | ||||||

| BBSs cost of capital | 9 | % | |||||

Assume straight line depreciation method is used. Required: Help BBS evaluate this project by calculating each of the following: 1. Accounting rate of return. (Round your answer to 1 decimal place.) 2. Payback period. (Round your answer to 2 decimal places.) 3. Net present value (NPV). (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round the final answer to nearest whole dollar.) 4. Recalculate the NPV assuming BBS's cost of capital is 12 percent. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Negative amount should be indicated by a minus sign. Round the final answer to nearest whole dollar.)

Question 8

8. After completing a long and successful career as senior vice president for a large bank, you are preparing for retirement. After visiting the human resources office, you have found that you have several retirement options to choose from:

Option A: An immediate cash payment of $1.07 million.

Option B: Payment of $65,000 per year for life.

Option C: Payment of $55,000 per year for 4 years and then $75,000 per year for life (this option is intended to give you some protection against inflation).

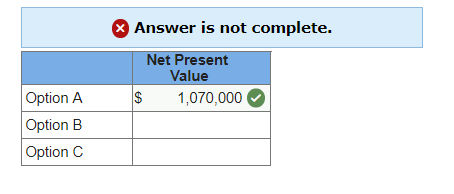

You believe you can earn 8 percent on your investments and your remaining life expectancy is 8 years. Required: 1. Calculate the net present value of each option. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Enter your answers in dollars but not in millions. Round the final answer to nearest whole dollar.)

Answer is not complete. Net Present Value 1,070,000 Option A Option B Option C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts