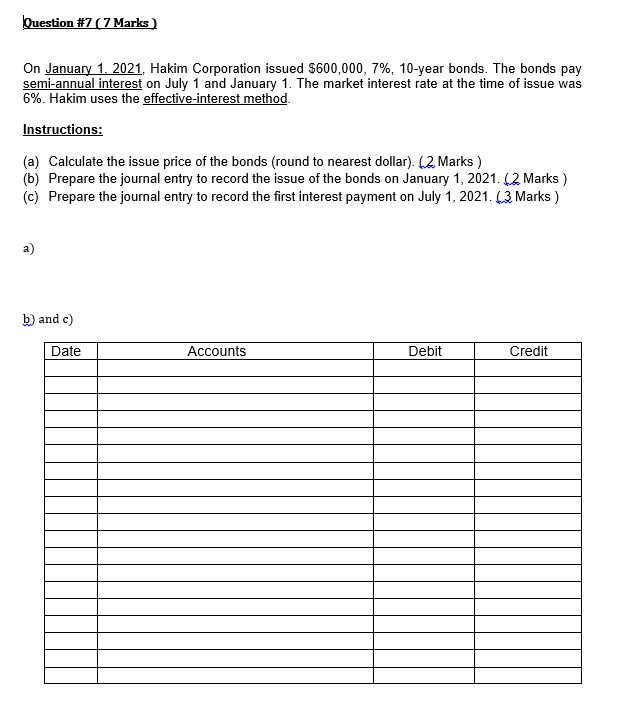

Question: Question #7 ( 7 Marks ) On January 1. 2021, Hakim Corporation issued $600,000, 7%, 10-year bonds. The bonds pay semi-annual interest on July 1

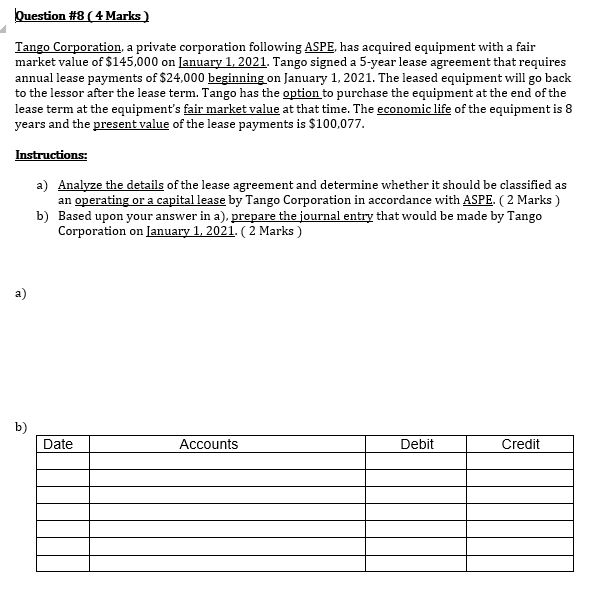

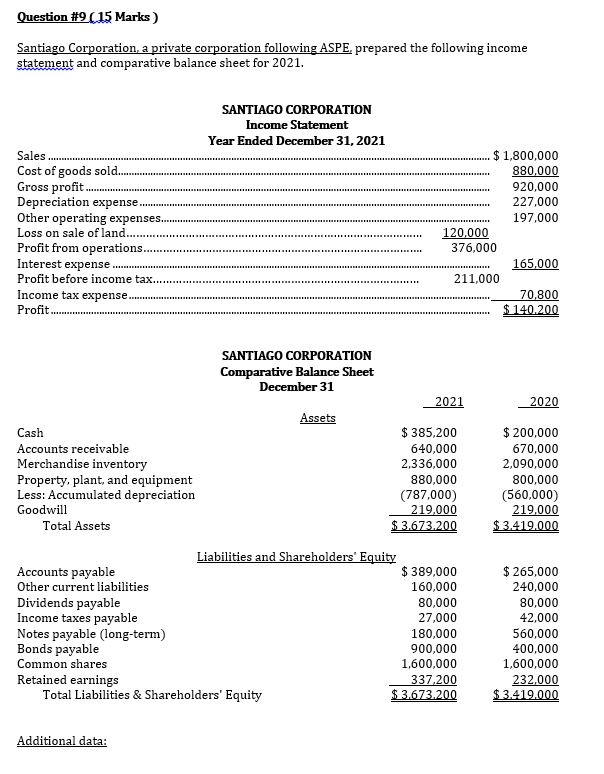

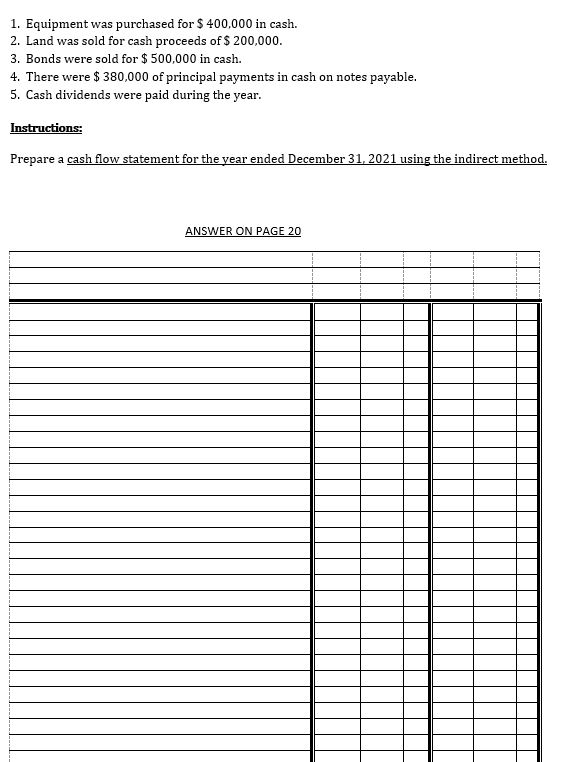

Question #7 ( 7 Marks ) On January 1. 2021, Hakim Corporation issued $600,000, 7%, 10-year bonds. The bonds pay semi-annual interest on July 1 and January 1. The market interest rate at the time of issue was 6%. Hakim uses the effective-interest method. Instructions: (a) Calculate the issue price of the bonds (round to nearest dollar). (2 Marks ) (b) Prepare the journal entry to record the issue of the bonds on January 1, 2021. (2 Marks ) (c) Prepare the journal entry to record the first interest payment on July 1, 2021. ( 3 Marks ) a) b) and c) Date Accounts Debit CreditQuestion #8 ( 4 Marks ) Tango Corporation, a private corporation following ASPE, has acquired equipment with a fair market value of $145,000 on January 1. 2021. Tango signed a 5-year lease agreement that requires annual lease payments of $24,000 beginning on January 1, 2021. The leased equipment will go back to the lessor after the lease term. Tango has the option to purchase the equipment at the end of the lease term at the equipment's fair market value at that time. The economic life of the equipment is 8 years and the present value of the lease payments is $100,077. Instructions: a) Analyze the details of the lease agreement and determine whether it should be classified as an operating or a capital lease by Tango Corporation in accordance with ASPE. ( 2 Marks ) b) Based upon your answer in a), prepare the journal entry that would be made by Tango Corporation on January 1. 2021. ( 2 Marks ) b) Date Accounts Debit Credit\f1. Equipment was purchased for $ 400,000 in cash. 2. Land was sold for cash proceeds of $ 200,000. 3. Bonds were sold for $ 500,000 in cash. 4. There were $ 380,000 of principal payments in cash on notes payable. 5. Cash dividends were paid during the year. Instructions: Prepare a cash flow statement for the year ended December 31, 2021 using the indirect method. ANSWER ON PAGE 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts