Question: Question 7 (7 points) Problem (7 Marks) Cobre Mining Ltd. is expecting to have 400,000 pounds of copper available for sale at the end of

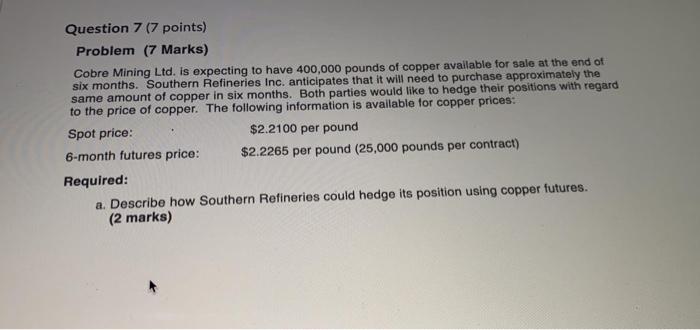

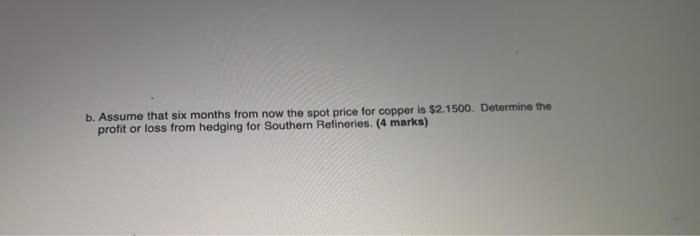

Question 7 (7 points) Problem (7 Marks) Cobre Mining Ltd. is expecting to have 400,000 pounds of copper available for sale at the end of six months. Southern Refineries Inc. anticipates that it will need to purchase approximately the same amount of copper in six months. Both parties would like to hedge their positions with regard to the price of copper. The following information is available for copper prices: Spot price: $2.2100 per pound 6-month futures price: $2.2265 per pound (25,000 pounds per contract) Required: a. Describe how Southern Refineries could hedge its position using copper futures. (2 marks) b. Assume that six months from now the spot price for copper is $2.1500. Determine the profit or loss from hedging for Southern Refineries. (4 marks) c. The purchaser does not have to put up the full amount of the future's purchase price. What is the term that refers to the amount the purchase does have to put up? (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts