Question: Question #7. (8 points) Raja and Brady form and LLC that is treated as a partnership for federal income tax purposes. Raja contributes property with

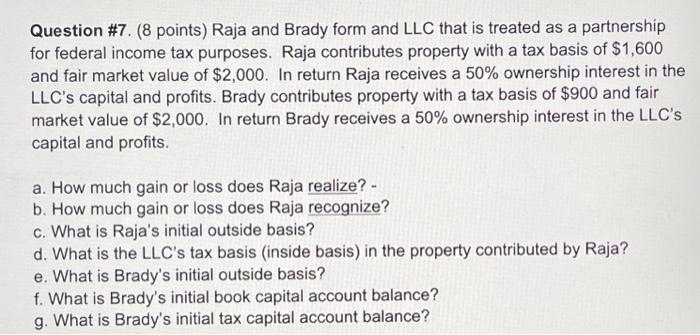

Question \#7. (8 points) Raja and Brady form and LLC that is treated as a partnership for federal income tax purposes. Raja contributes property with a tax basis of $1,600 and fair market value of $2,000. In return Raja receives a 50% ownership interest in the LLC's capital and profits. Brady contributes property with a tax basis of $900 and fair market value of $2,000. In return Brady receives a 50% ownership interest in the LLC's capital and profits. a. How much gain or loss does Raja realize? - b. How much gain or loss does Raja recognize? c. What is Raja's initial outside basis? d. What is the LLC's tax basis (inside basis) in the property contributed by Raja? e. What is Brady's initial outside basis? f. What is Brady's initial book capital account balance? g. What is Brady's initial tax capital account balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts